What’s the Latest News on Ball Corporation?

Ball Corporation (BLL) reported 3Q16 net sales of $2.8 billion, a rise of 33.3% compared to net sales of $2.1 billion in 3Q15.

Dec. 15 2016, Updated 9:05 a.m. ET

Price movement

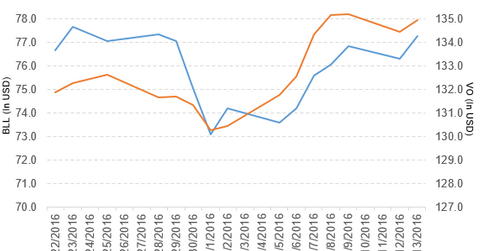

Ball Corporation (BLL) has a market cap of $13.4 billion. It rose 1.3% to close at $77.28 per share on December 13, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 4.2%, 1.9%, and 7.0%, respectively, on the same day.

BLL is trading 1.9% above its 20-day moving average, 0.33% below its 50-day moving average, and 3.8% above its 200-day moving average.

Related ETF and peers

The Vanguard Mid-Cap ETF (VO) invests 0.33% of its holdings in Ball Corporation. The YTD price movement of VO was 13.5% on December 13.

The market caps of Ball’s competitors are as follows:

Latest news on Ball Corporation

In a press release, Ball Corporation reported, “Ball Corporation (BLL) announced today that it intends to cease production at the company’s Reidsville, North Carolina, beverage packaging plant in mid-2017. The plant’s customers will be supplied by other Ball facilities in the U.S.

“Ball expects to record an after-tax charge of approximately $18 million, primarily for employee severance, pensions and other benefits, asset impairments, and facility shut down and disposal costs. The majority of this charge is expected to be recorded by mid-2017 and the net, after-tax cash costs are expected to be approximately $5 million.”

Ball Corporation’s performance in 3Q16

Ball Corporation (BLL) reported 3Q16 net sales of $2.8 billion, a rise of 33.3% compared to net sales of $2.1 billion in 3Q15. Sales in its Beverage Packaging of North and Central America, Beverage Packaging of Europe, and Beverage Packaging of South America segments rose 31.5%, 52.7%, and 137.3%, respectively, and sales of the Food and Aerosol Packaging segment fell 11.6% in 3Q16 compared to 3Q15.

The company’s EBIT[1. earnings before interest and tax] margin rose 50 basis points in 3Q16 compared to 3Q15. It reported adjusted EPS of $0.96 in 3Q16, a fall of 12.7% compared to 3Q15.

Ball’s cash and cash equivalents and net inventories rose 164.3% and 61.9%, respectively, in 3Q16, compared to 3Q15. Its current ratio rose to 1.4x, and its long-term debt-to-equity ratio fell to 2.0x in 3Q16, compared to 1.0x and 2.3x, respectively, in 3Q15.

In the next part, we’ll discuss PepsiCo (PEP).