Tyson Foods Forms a New Venture Capital Fund to Focus on Growth

In fiscal 2016, Tyson Foods (TSN) reported sales of $36.9 billion, a fall of 10.9% year-over-year.

Dec. 6 2016, Updated 4:35 p.m. ET

Price movement

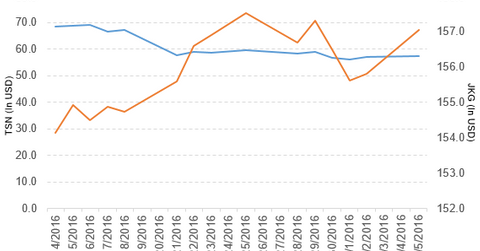

Tyson Foods (TSN) has a market cap of $20.3 billion. It rose 0.39% to close at $57.27 per share on December 5, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.5%, -17.8%, and 8.5%, respectively, on the same day.

TSN is trading 9.7% below its 20-day moving average, 16.2% below its 50-day moving average, and 15.8% below its 200-day moving average.

Related ETF and peers

The iShares Morningstar Mid Core ETF (JKG) invests 1.3% of its holdings in Tyson Foods. The YTD price movement of JKG was 11.1% on December 5.

The market caps of Tyson Foods’s competitors are as follows:

Latest news on TSN

In a press release on December 5, 2016, Tyson Foods reported, “As part of its commitment to innovation and growth, Tyson Foods, Inc. (TSN) has launched a venture capital fund focused on investing in companies developing breakthrough technologies, business models and products to sustainably feed a growing world population.

“Tyson will make available $150 million to the fund, which has been named Tyson New Ventures LLC, to complement the company’s continuing investments in innovation in its core fresh meats, poultry and prepared foods businesses.

“The fund will concentrate on three areas in the foods space: commercializing delicious, safe and affordable alternative proteins; tackling food insecurity and food insecurity and food loss through market making and other commercial models; and tapping the internet of food to promote more precise and productive resource application, safety, and consumer empowerment in the food chain.”

Performance of Tyson Foods in fiscal 4Q16

Tyson Foods (TSN) reported fiscal 4Q16 sales of $9.2 billion, a 12.8% fall compared to its sales of $10.5 billion in fiscal 4Q15. Tyson Foods’s gross profit margin and operating margin expanded 250 basis points and 120 basis points, respectively, in fiscal 4Q16 compared to fiscal 4Q15.

The company’s net income and EPS (earnings per share) rose to $391.0 million and $1.03, respectively, in fiscal 4Q16, compared to $258.0 million and $0.63, respectively, in fiscal 4Q15. It reported adjusted EPS of $0.96 in fiscal 4Q16, a rise of 15.7% compared to fiscal 4Q15.

Fiscal 2016 results

In fiscal 2016, Tyson Foods (TSN) reported sales of $36.9 billion, a fall of 10.9% YoY (year-over-year). The company’s gross profit margin and operating margin expanded 320 basis points and 250 basis points, respectively, in fiscal 2016.

Tyson Foods’s net income and EPS rose to $1.8 billion and $4.53, respectively, in fiscal 2016, compared to $1.2 billion and $2.95, respectively, in fiscal 2015. It reported adjusted EPS of $4.39 in fiscal 2016, a rise of 39.4% YoY.

Tyson Foods’s cash and cash equivalents and inventories fell 49.3% and 5.1%, respectively, in fiscal 2016. Its current ratio rose to 1.8x, and its debt-to-equity ratio fell to 1.3x in fiscal 2016, compared to its current and debt-to-equity ratios of 1.5x and 1.4x, respectively, in fiscal 2015.