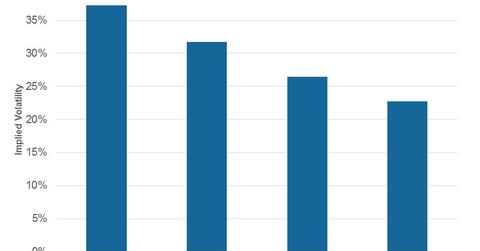

Where Are Refining Stocks’ Implied Volatilities Positioned?

Marathon Petroleum’s (MPC) implied volatility currently stands at 37%, the highest among its peers.

Dec. 5 2016, Updated 11:05 a.m. ET

Refining stocks’ implied volatilities

Marathon Petroleum’s (MPC) implied volatility currently stands at 37%, the highest among its peers Valero Energy (VLO), Tesoro (TSO), and Phillips 66 (PSX). On the other hand, Phillips 66 has the lowest implied volatility at 23%.

VLO and TSO have implied volatilities of 26% and 32%, respectively. For exposure to these stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~7% exposure to refining and marketing sector stocks.

Move on to the next article to find out how refining stocks’ valuations are placed compared to their historic values.