Why Zoetis Expects to See Robust Revenue Growth in 2017

Zoetis (ZTS) has adopted a targeted R&D strategy that has resulted in multiple new product launches.

May 17 2017, Updated 7:37 a.m. ET

Growth drivers

Zoetis (ZTS) has adopted a targeted R&D (research and development) strategy that has resulted in multiple new product launches as well as the meaningful extension of the lifecycle of its existing products. This strategy has mainly benefited the company’s Companion Animal Health segment, which is a key revenue driver for Zoetis.

In 1Q17, Zoetis reported revenues of around $1.2 billion, which represented a YoY (year-over-year) operational growth of ~6%. However, excluding the revenue impact of about -2% from product rationalization, Zoetis reported 8% YoY revenue growth in 1Q17.

The company’s product rationalization strategy is expected to have an impact of around -$50 million, or -1%, on the company’s sales in 2017. While Zoetis expects to see a major part of this impact in 1H17, the company anticipates minimal to no negative influence on its revenues in 2H17. Zoetis is confident that it will report an above-average revenue growth rate in 2017.

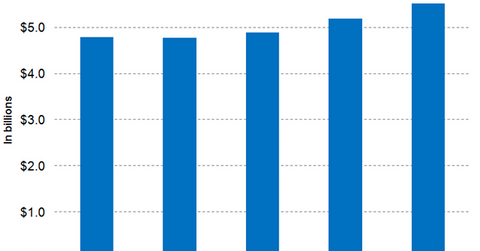

Revenue growth projections

Wall Street analysts have projected that Zoetis will report revenues of around $5.2 billion for fiscal 2017, which would represent a YoY growth of ~6.2%. These projections are in line with the revenue guidance provided by Zoetis, as the company has predicted YoY operational revenue growth in the range of 5.5%–7.5% for 2017.

In 2017, animal health peers Eli Lilly (LLY), Merck (MRK), and Sanofi (SNY) are expected to report annual revenues close to $22.1 billion, $39.9 billion, and $39.3 billion, respectively.

Notably, Zoetis makes up about 0.42% of the iShares Russell Mid-Cap ETF’s (IWR) total portfolio holdings.

In the next part of this series, we’ll discuss growth trends for Zoetis’s Companion Animal Health segment in greater detail.