Bausch & Lomb Continues to be Key Growth Driver for Valeant

Bausch & Lomb projections Valeant Pharmaceuticals expects its Bausch & Lomb/International segment to grow at a CAGR (compound average growth rate) of 4%–6% between 2017 and 2020. In 2017, the company expects the segment to grow 5%–7% after adjusting for foreign exchange fluctuations and the impact of impending patent expiries. In 2017, the segment is also expected […]

March 24 2017, Updated 10:35 a.m. ET

Bausch & Lomb projections

Valeant Pharmaceuticals expects its Bausch & Lomb/International segment to grow at a CAGR (compound average growth rate) of 4%–6% between 2017 and 2020. In 2017, the company expects the segment to grow 5%–7% after adjusting for foreign exchange fluctuations and the impact of impending patent expiries. In 2017, the segment is also expected to benefit from lower pipeline inventories in Eastern European markets, especially in Russia and Poland. These factors may help Valeant compete with competitors Novartis (NVS), Merck (MRK), and Johnson & Johnson (JNJ). To learn more about the Bausch & Lomb/International segment, please refer to International Segment: Key Driver of VRX’s Revenue Growth in 2016.

If the Bausch & Lomb/International segment manages to surpass these revenue projections in 2017, Valeant’s share price and that of the PowerShares Dynamic Pharmaceuticals ETF (PJP) may rise. Valeant makes up about 2.7% of PJP’s portfolio.

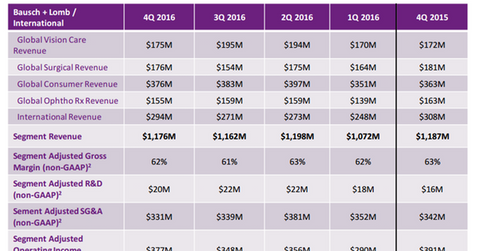

The above diagram shows the Bausch & Lomb/International segment’s performance for the last five quarters, according to subsegment.

New product launches

On December 12, 2016, Valeant launched Zenlens diagnostic lenses in 28 new formats in the US market. On January 10, 2017, it announced that it had expanded the parameter range for its ULTRA contact lenses for presbyopia. Furthermore, on January 18, 2017, the company introduced its Zen RC scleral lenses. On January 25, 2017, Valeant launched its ScleraFil solution for scleral lenses. In the next article, we’ll study growth prospects for Valeant’s investigational therapy, Vyzulta, in 2017.