Lower Fuel Margins Drove Casey’s 2Q17 Earnings Miss

Gasoline sales accounted for 58.0% of Casey’s (CASY) total revenue in fiscal 2Q17. Total gasoline sales fell 4.6% YoY (year-over-year) in fiscal 2Q17.

Dec. 13 2016, Updated 8:07 a.m. ET

Gasoline sales showed improvement in fiscal 2Q17

Gasoline sales accounted for 58.0% of Casey’s (CASY) total revenue in fiscal 2Q17. Total gasoline sales fell 4.6% YoY (year-over-year) in the quarter. However, it was one of the company’s best quarters in terms of gasoline sales for the last two years. Fuel sales have fallen an average of 17.6% in the last seven quarters.

Fiscal 2Q17 fuel sales exceeded targets

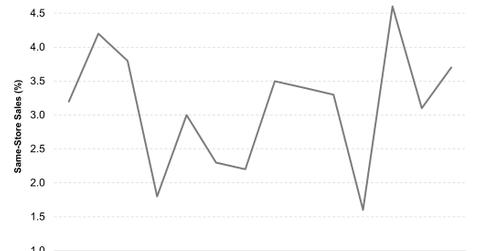

Casey’s fiscal 2Q17 fuel sales exceeded its goals for the current fiscal year. Same-store gallons rose 3.7% during the quarter compared to the annual goal of 2.0%.

Terry Handley, Casey’s president and CEO (chief executive officer), commented, “Same-store gallons sold for the quarter were well ahead of the annual goal as retail fuel prices remained low and the fuel saver programs continued to drive incremental gallon sales.”

The average fuel margin was 18.6 cents per gallon compared to the goal of 18.4 cents per gallon. However, the fuel margin per gallon fell YoY due to a lower volatility in wholesale fuel costs. The company recorded an average fuel margin of 19.1 cents in 2Q16. A lower fuel margin was the primary reason behind Casey’s earnings miss in the quarter and impacted the company’s earnings by about 52.0 cents per share.

The company also sold 17.8 million RINs (renewable fuel credits) for $15.9 million during the quarter, which provided a cushion of 3.0 cents per gallon to Casey’s fuel margins.

Volatility in fuel prices has impacted other convenience stores and supermarkets

For fuel sales, Casey’s competes with gasoline station operators such as Sunoco (SUN), convenience store chains such as CST Brands (CST) and Murphy USA (MUSA), and non-traditional fuel retailers such as Kroger (KR).

Uncertainty in fuel prices has impacted the financial performance of all these players. Kroger, which reported its results on December 1, 2016, reported a 120-basis point hit on its top line due to a weakness in fuel prices. The company’s sales rose 7.1% YoY, excluding fuel sales, and 5.9% YoY after including the impact of fuel sales.

If you’re looking for exposure to Casey’s, you can invest in the iShares S&P Mid-Cap 400 Growth (IJK), which has about 0.33% of its holdings in the company.