Casey's General Stores Inc

Latest Casey's General Stores Inc News and Updates

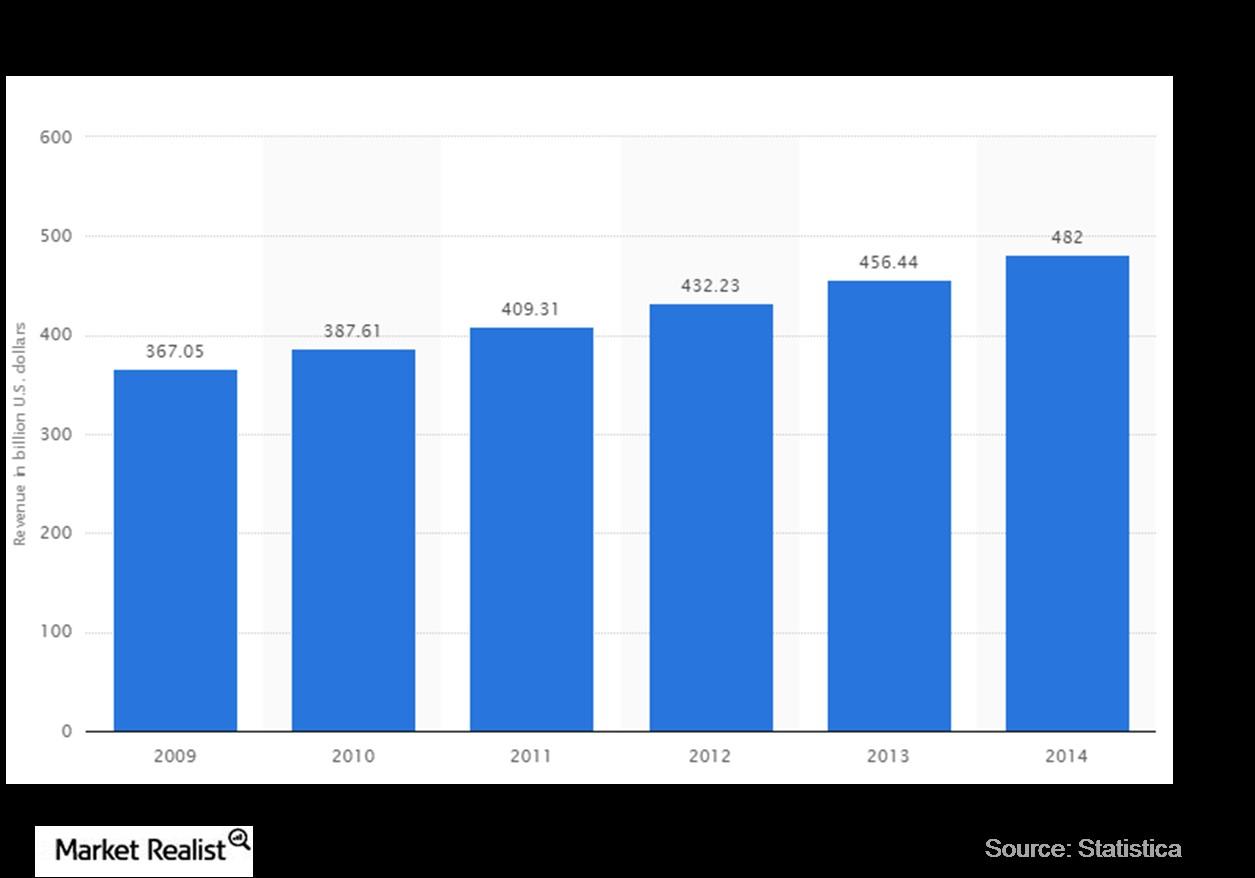

An Overview of US Gas Stations with Convenience Stores

Casey’s, as per the North American Industry Classification System (NAICS), falls under the sub-category of gas stations with convenience stores.

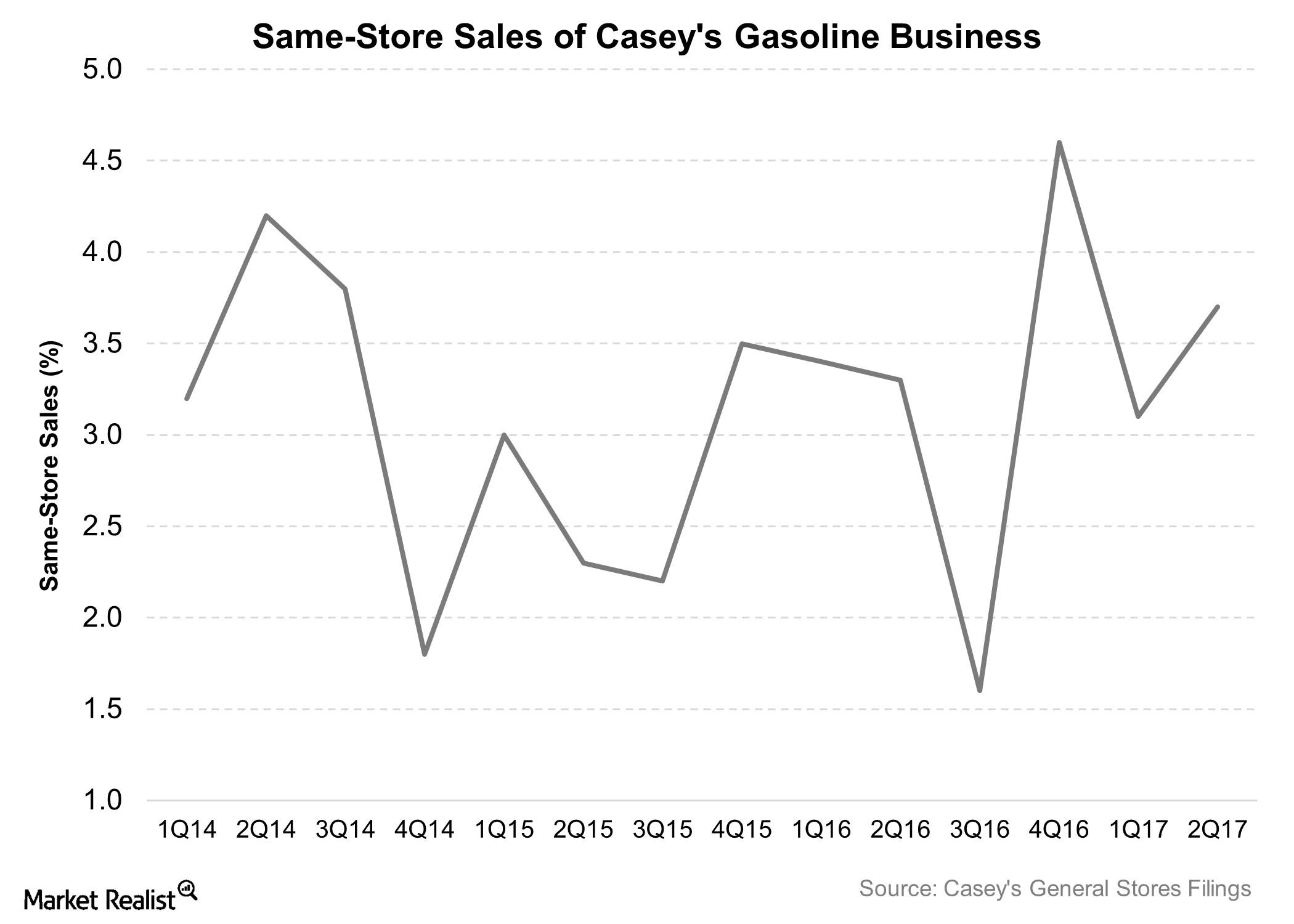

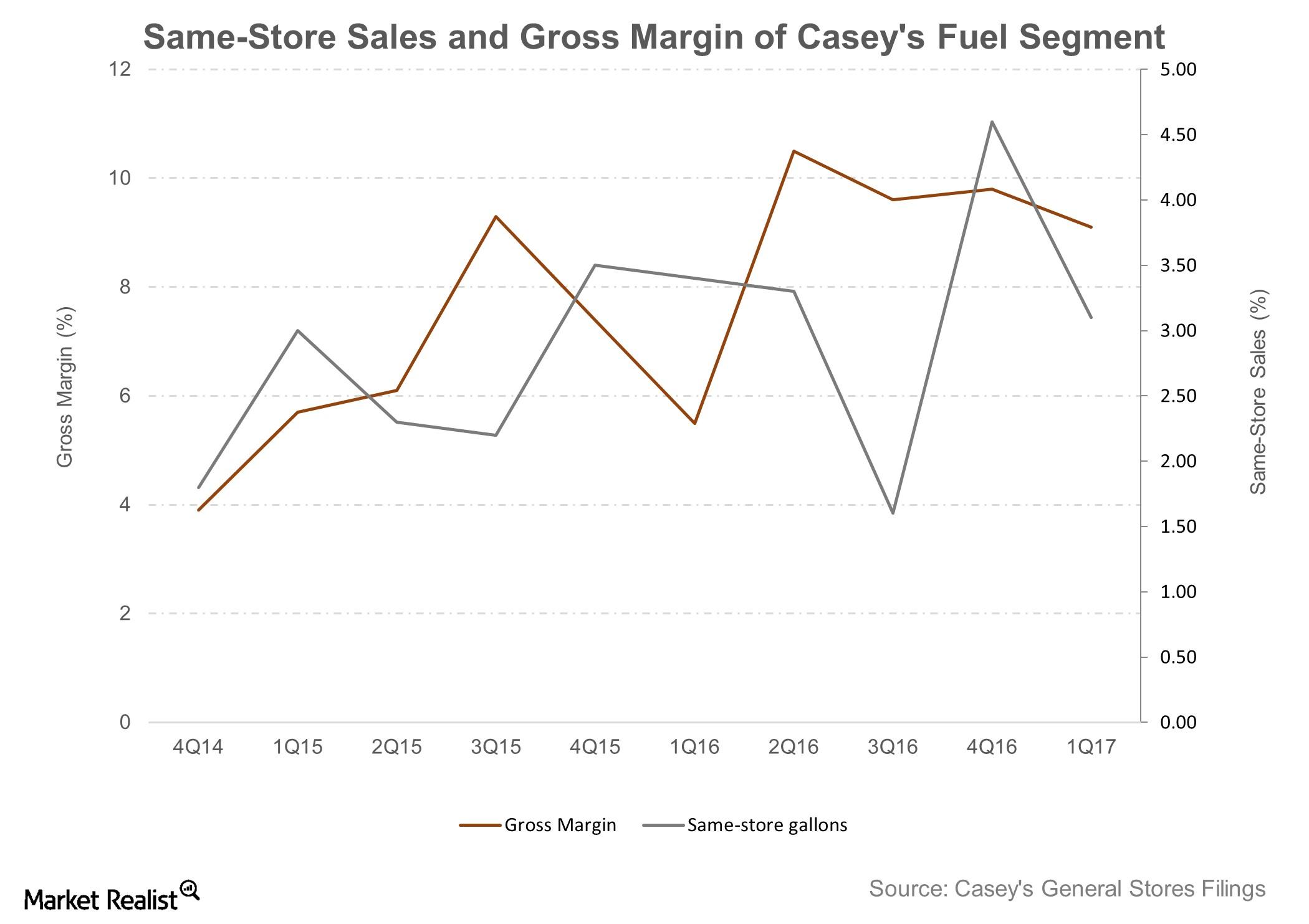

Lower Fuel Margins Drove Casey’s 2Q17 Earnings Miss

Gasoline sales accounted for 58.0% of Casey’s (CASY) total revenue in fiscal 2Q17. Total gasoline sales fell 4.6% YoY (year-over-year) in fiscal 2Q17.

Casey’s Gasoline Sales Witnessed a Resurgence in 1Q17

Gasoline sales accounted for 58.2% of Casey’s (CASY) total revenue in 1Q17.

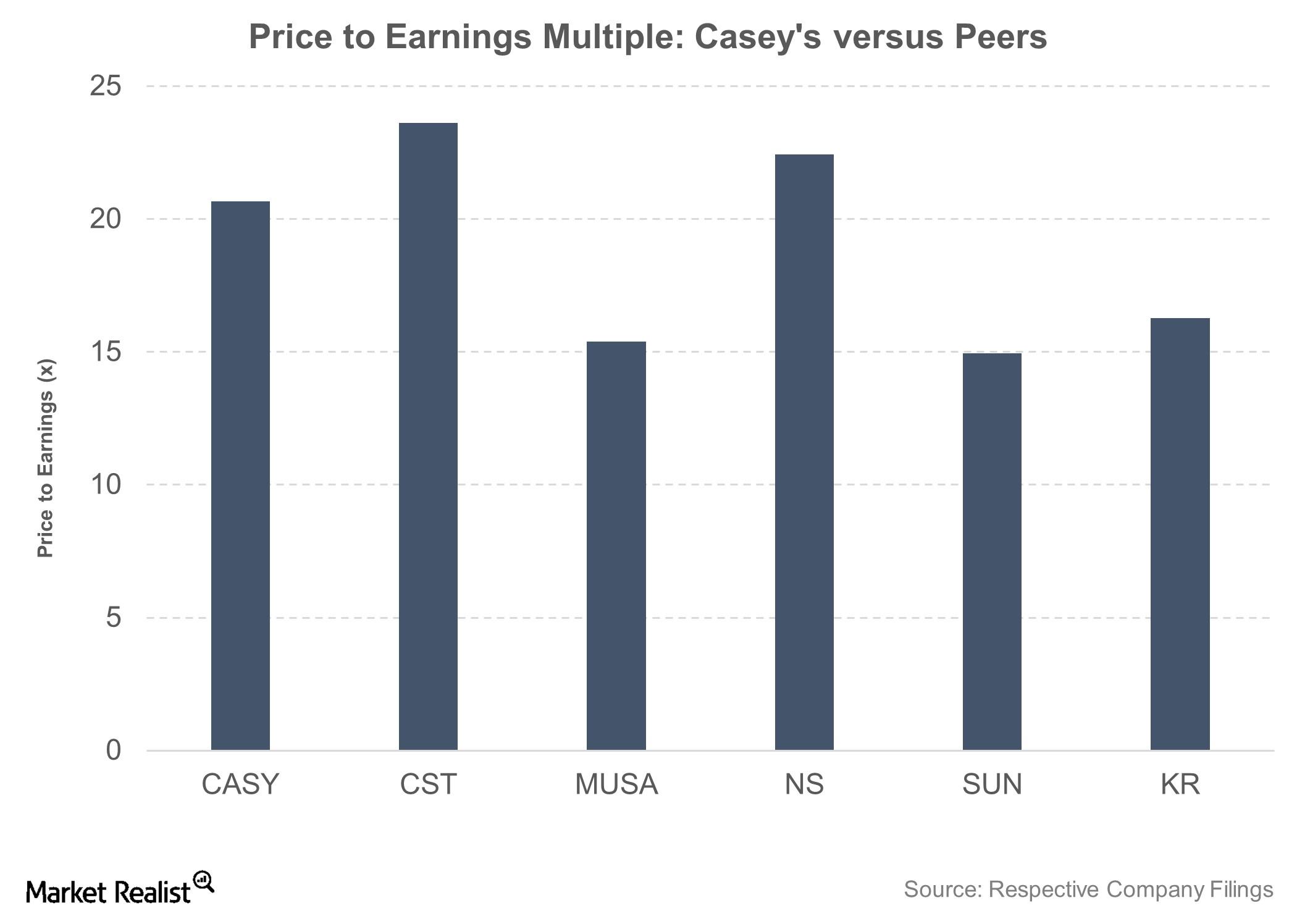

How Do Casey’s Valuations Stack Up against Its Peers’?

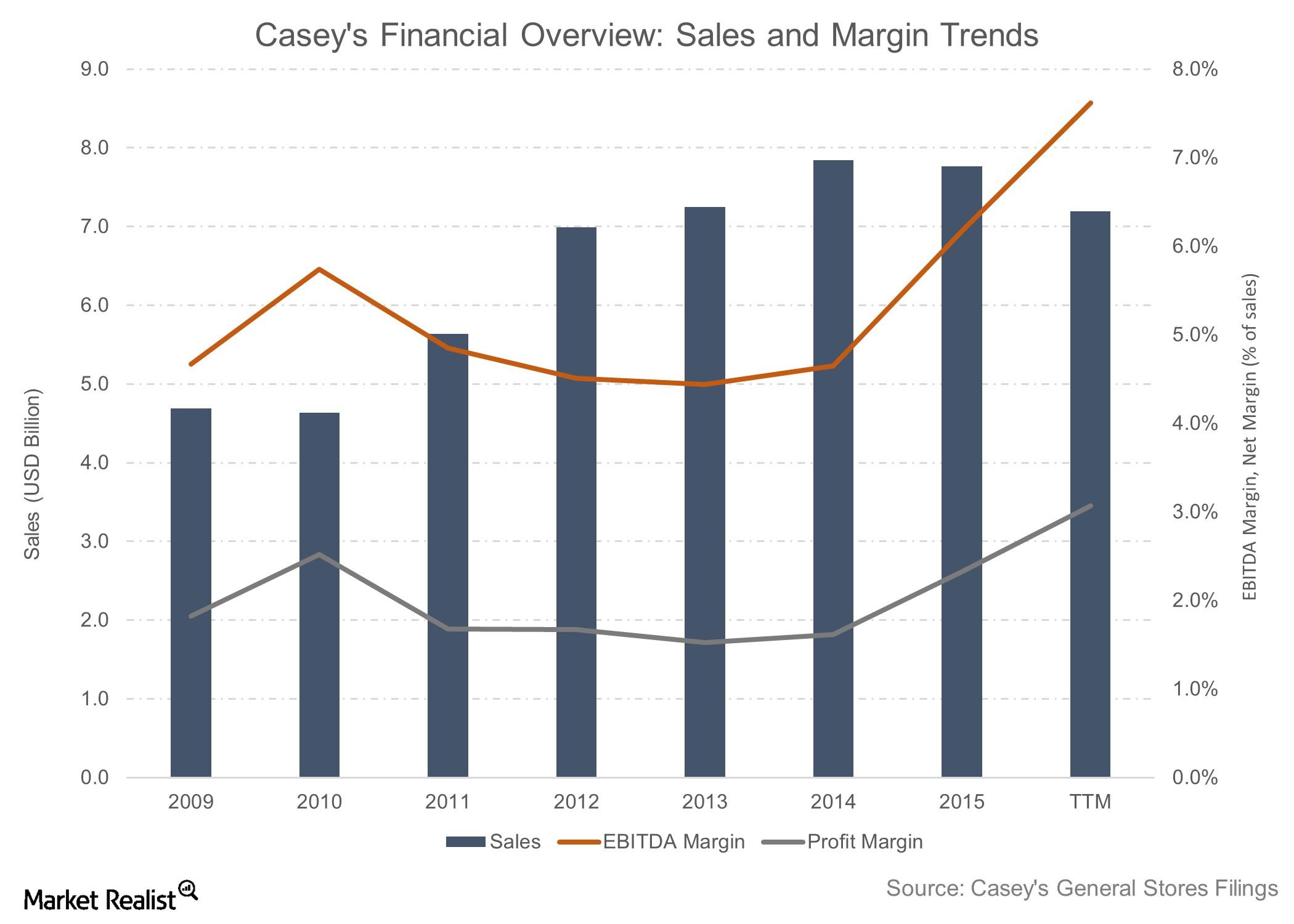

After Casey’s General Stores’ double-digit earnings growth over the last three fiscal years, Wall Street expects a slowdown in its earnings per share growth.

Casey’s Strengths, Weaknesses, Opportunities, and Threats

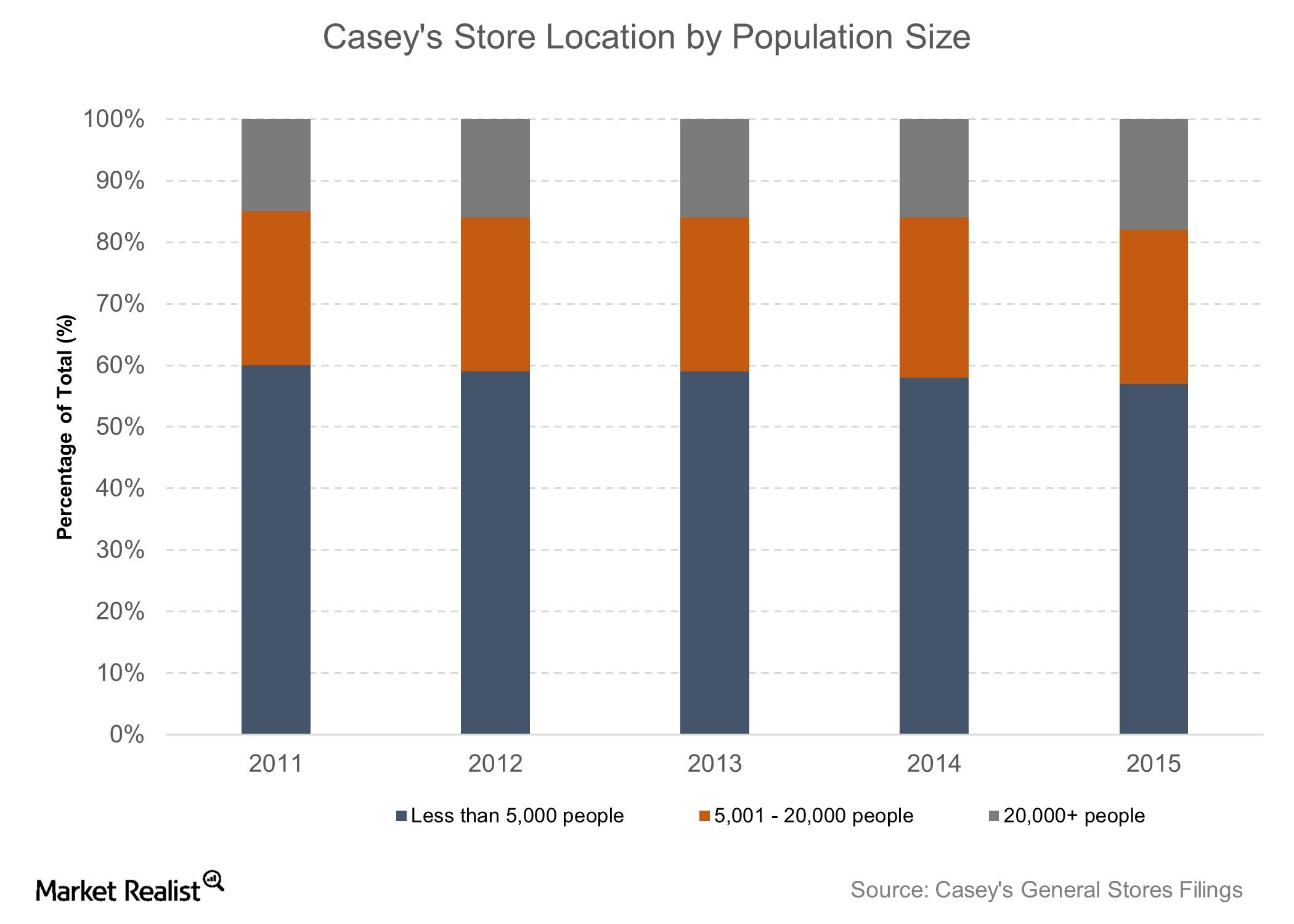

Casey’s has a strong, differentiated, low-risk business model. In fiscal 2015, 82% of its stores were in areas with populations of fewer than 20,000 people.

An Overview of Casey’s Business Strategies

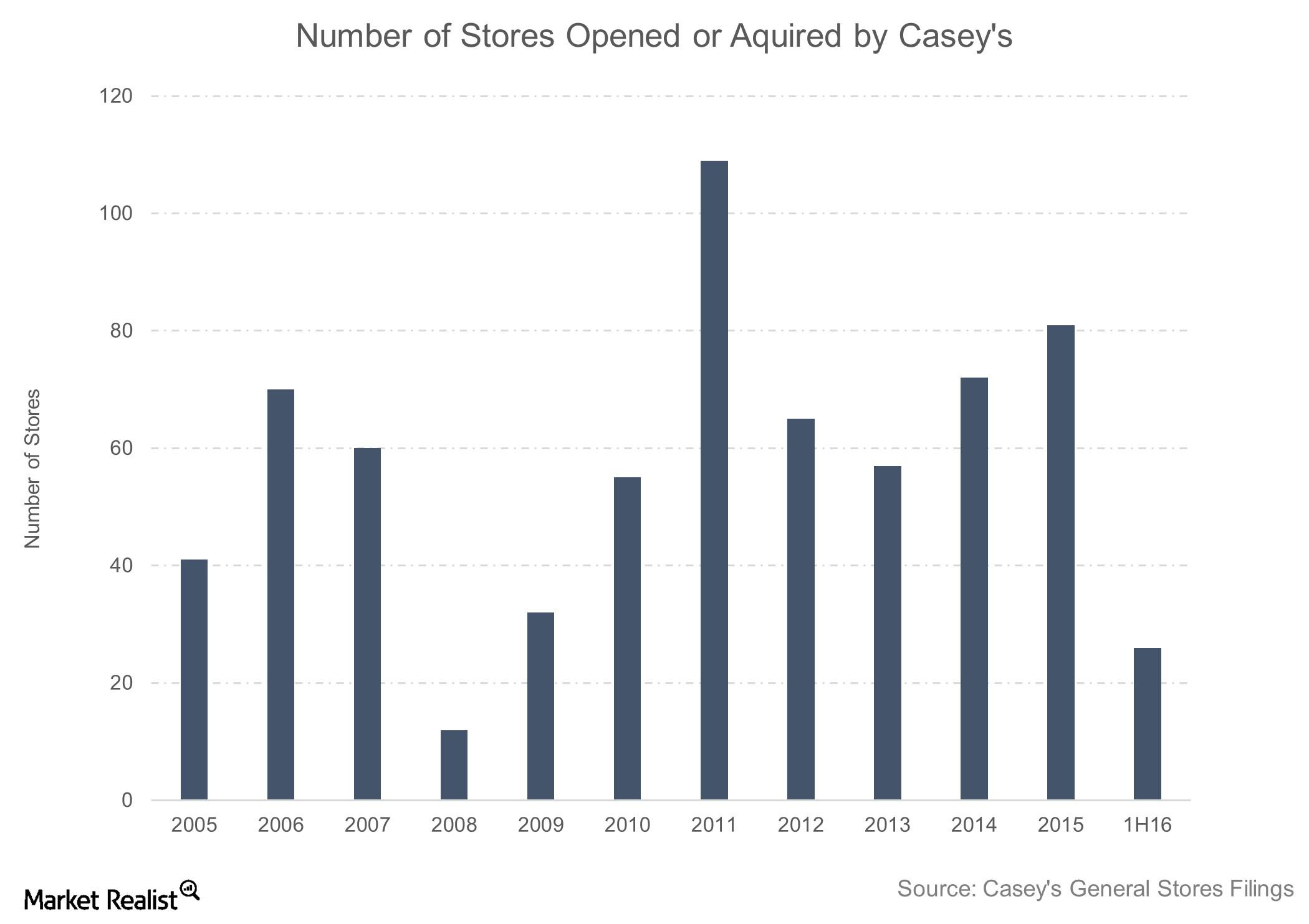

Casey follows both organic and inorganic expansion strategies for its growth. In fiscal 2015, the company opened 45 new stores and acquired 36 stores.

A Quick Look at Casey’s Business Model

Casey’s business model focuses on opening stores in smaller towns, where the population is lower and competition is minimal.

Company Overview: An Introduction to Casey’s General Stores

Casey’s General Stores’ strong and differentiated business model has resulted in the company’s delivering total returns of 27% in the last year.

How an Economic Cycle Can Impact Mutual Funds

All that goes up must come down. And this applies to economic cycles as well. No boom lasts forever, and all economies experience a slowdown.