CST Brands Inc

Latest CST Brands Inc News and Updates

Lower Fuel Margins Drove Casey’s 2Q17 Earnings Miss

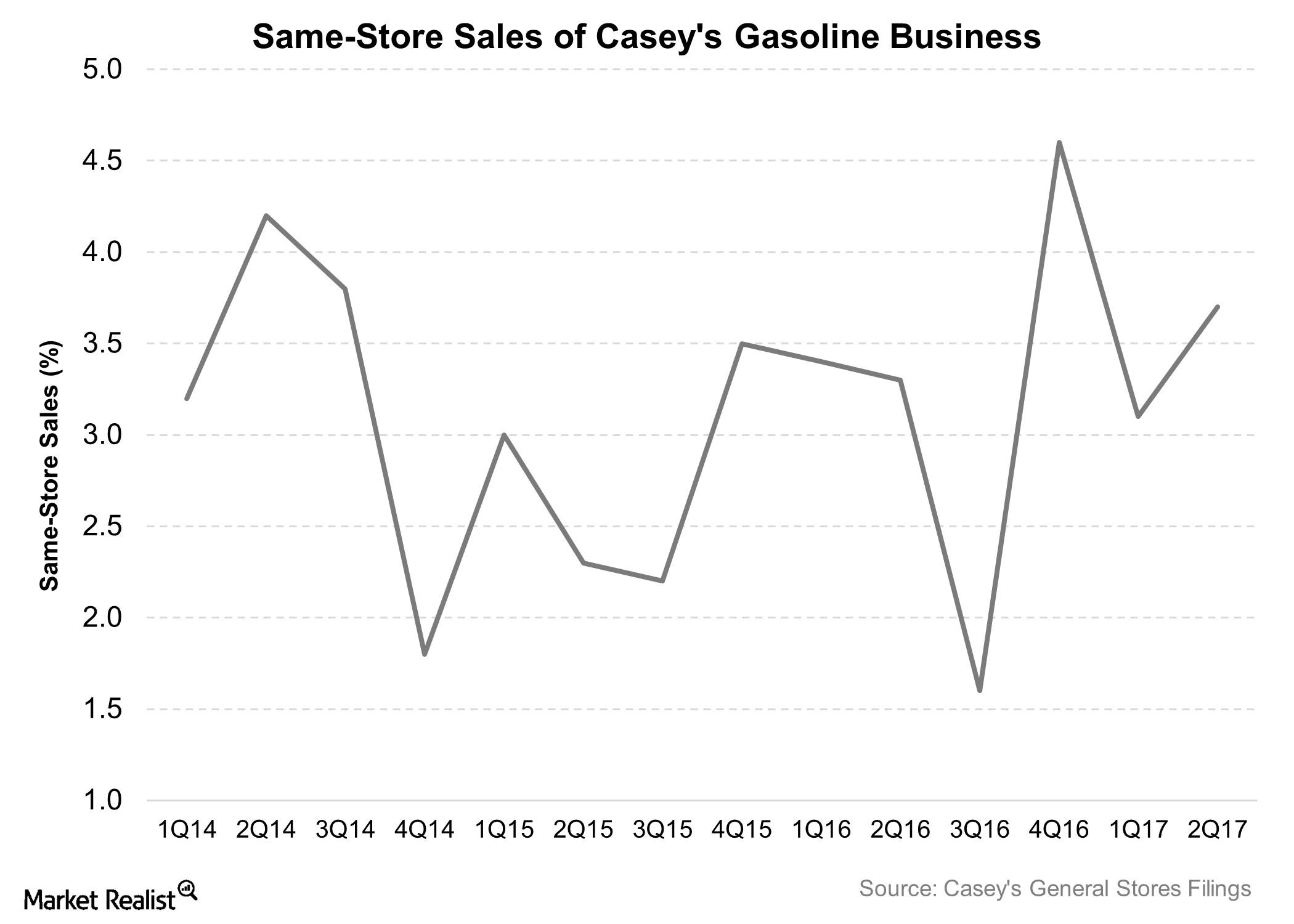

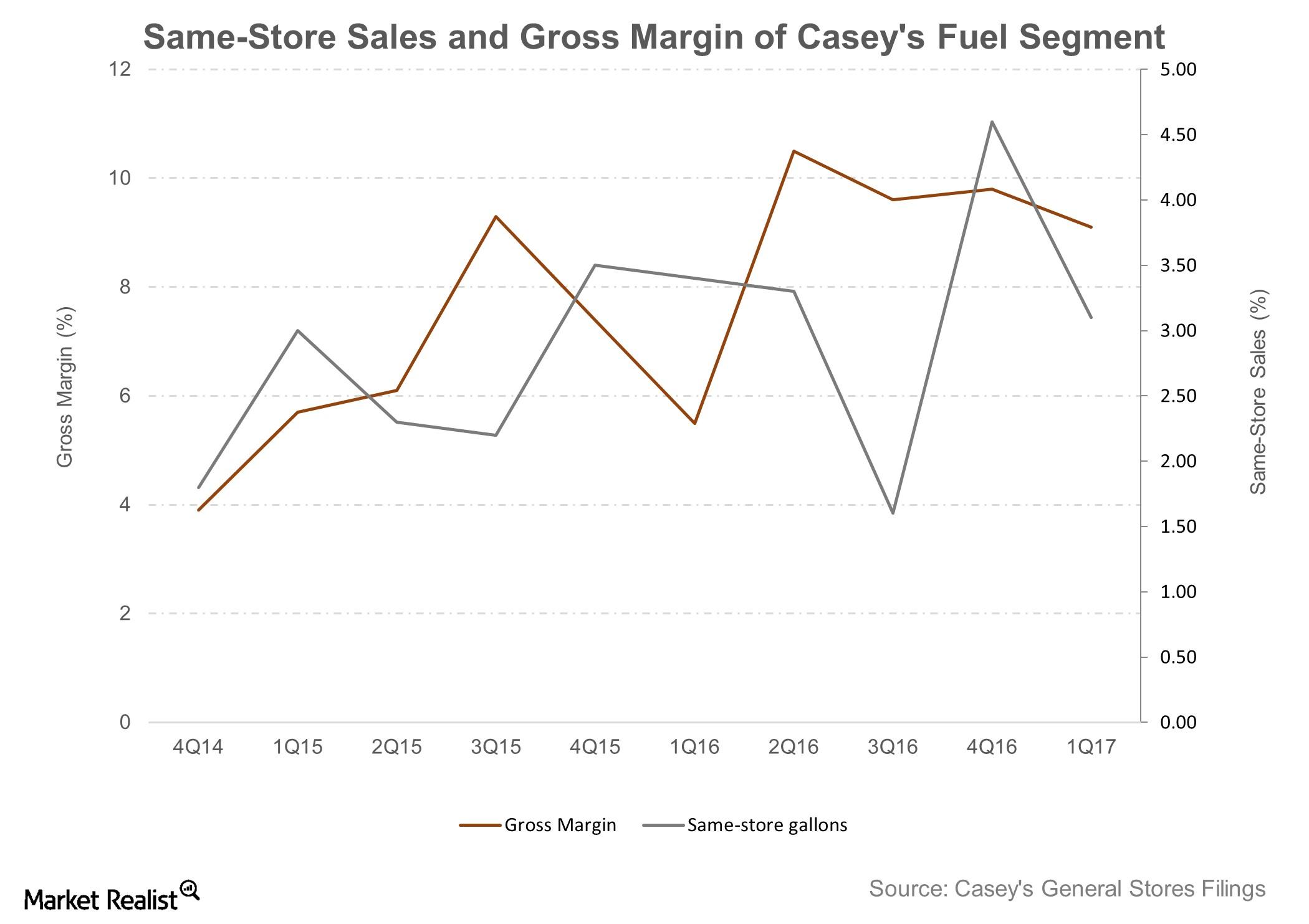

Gasoline sales accounted for 58.0% of Casey’s (CASY) total revenue in fiscal 2Q17. Total gasoline sales fell 4.6% YoY (year-over-year) in fiscal 2Q17.

Casey’s Gasoline Sales Witnessed a Resurgence in 1Q17

Gasoline sales accounted for 58.2% of Casey’s (CASY) total revenue in 1Q17.

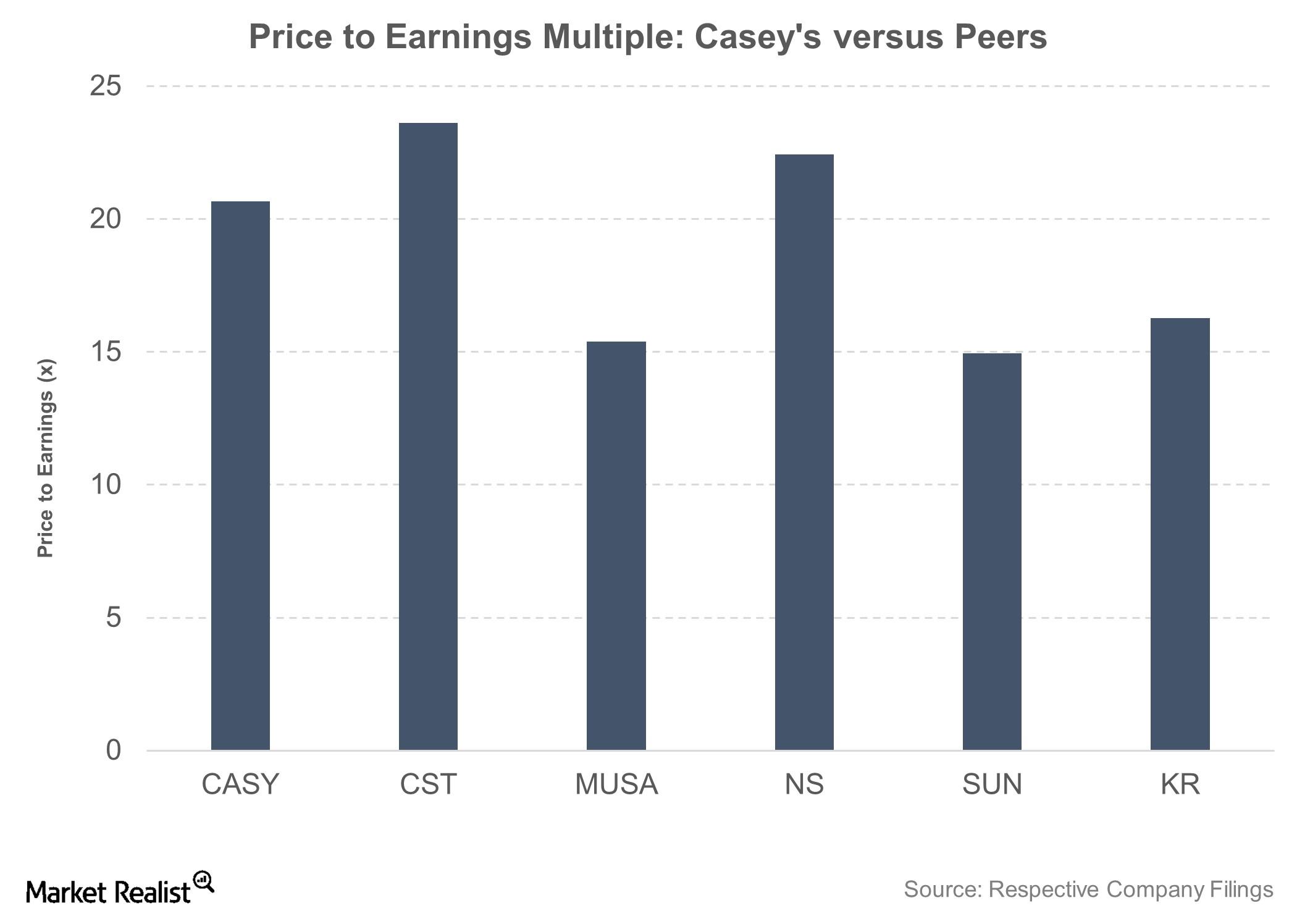

How Do Casey’s Valuations Stack Up against Its Peers’?

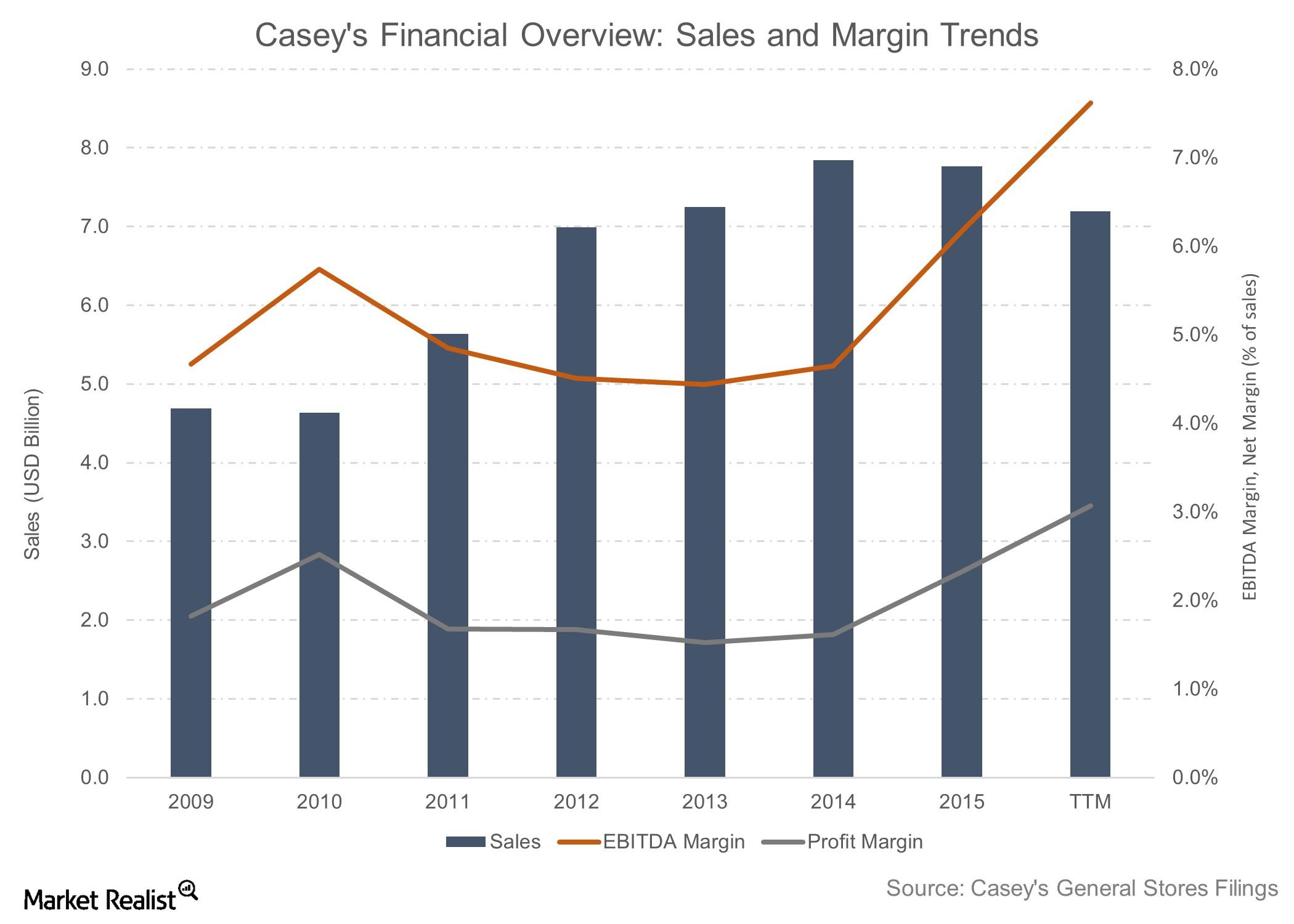

After Casey’s General Stores’ double-digit earnings growth over the last three fiscal years, Wall Street expects a slowdown in its earnings per share growth.

Casey’s Strengths, Weaknesses, Opportunities, and Threats

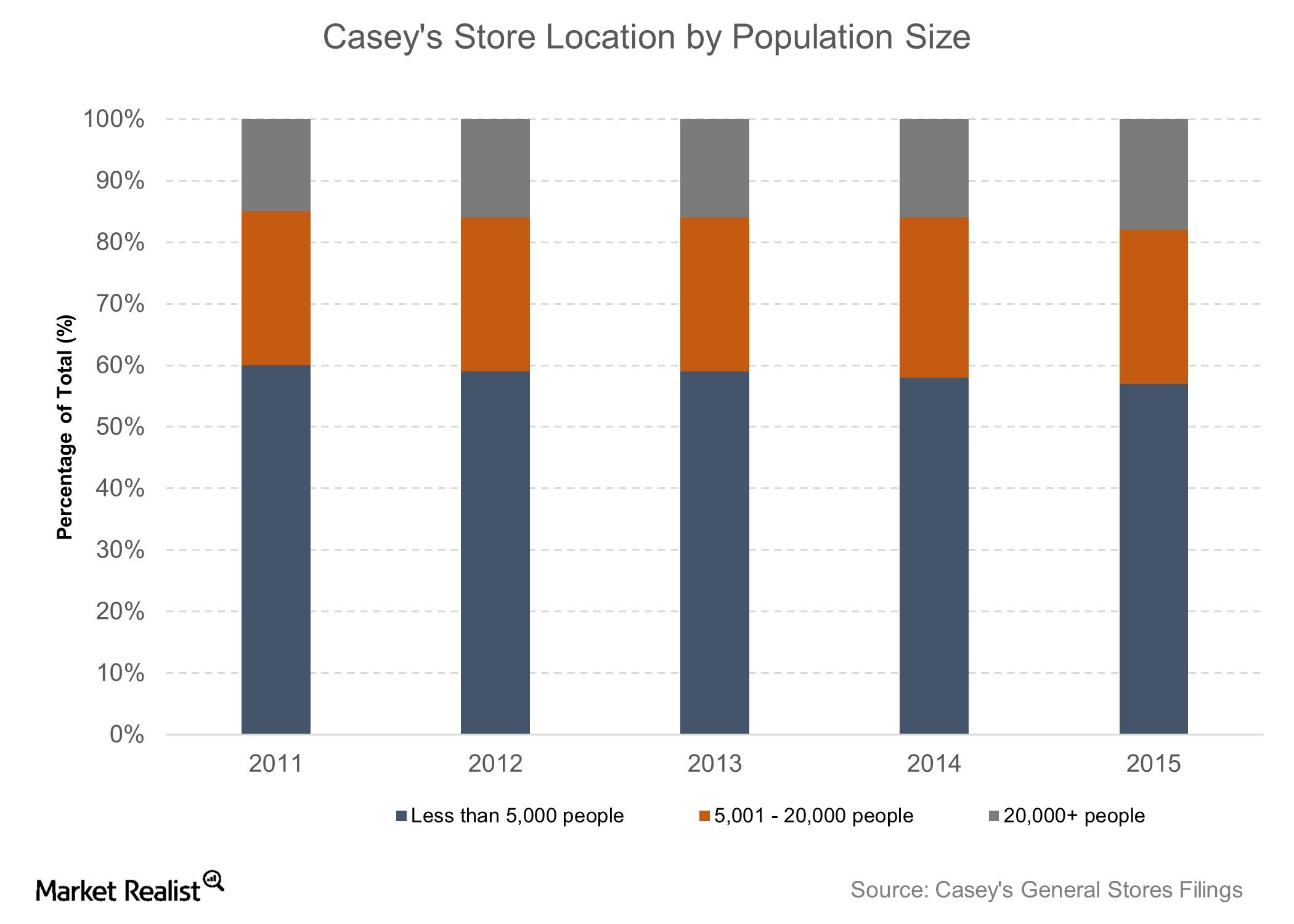

Casey’s has a strong, differentiated, low-risk business model. In fiscal 2015, 82% of its stores were in areas with populations of fewer than 20,000 people.

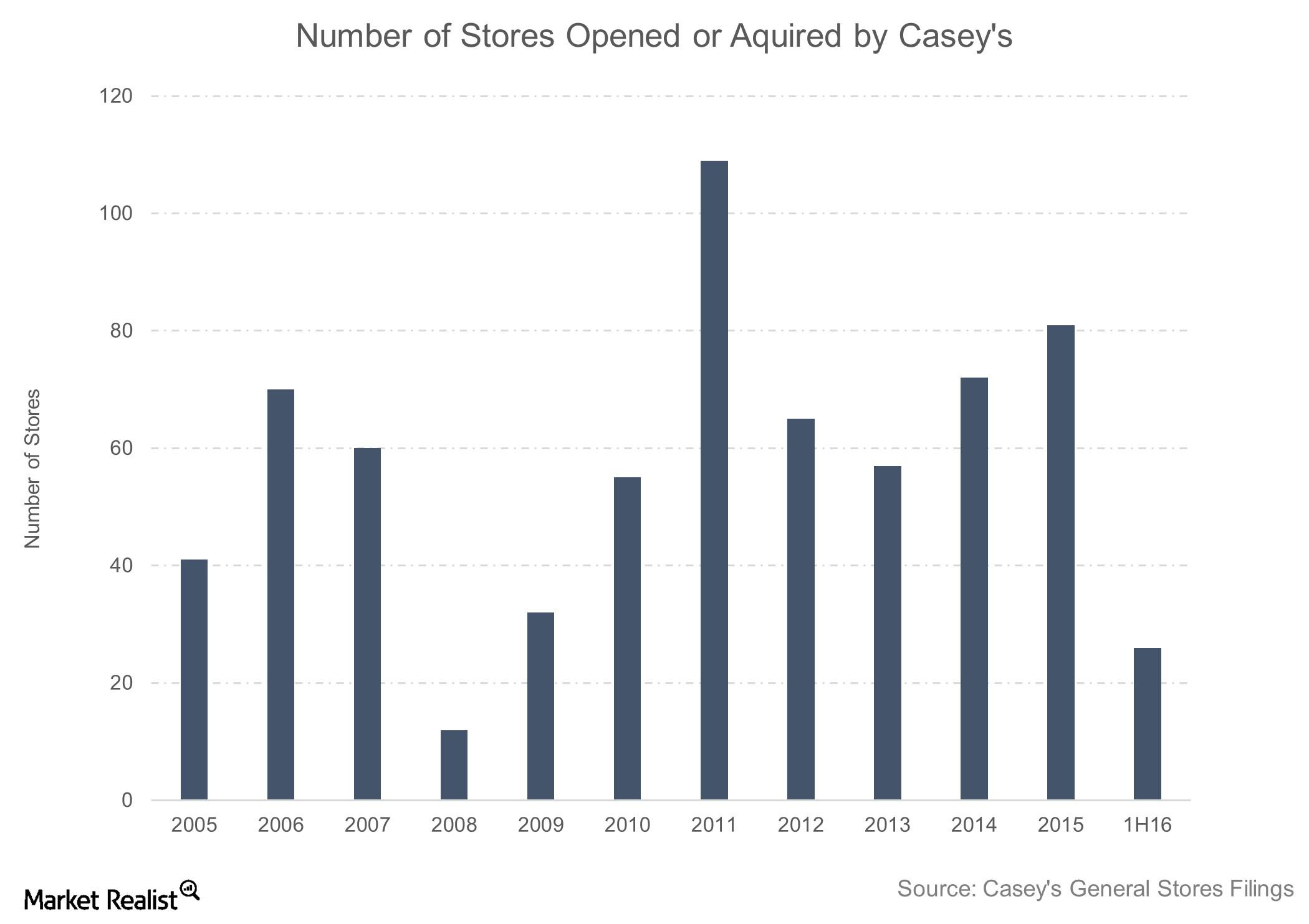

An Overview of Casey’s Business Strategies

Casey follows both organic and inorganic expansion strategies for its growth. In fiscal 2015, the company opened 45 new stores and acquired 36 stores.

A Quick Look at Casey’s Business Model

Casey’s business model focuses on opening stores in smaller towns, where the population is lower and competition is minimal.

Company Overview: An Introduction to Casey’s General Stores

Casey’s General Stores’ strong and differentiated business model has resulted in the company’s delivering total returns of 27% in the last year.