Why Did Crude Oil Prices Hit a 16-Month High?

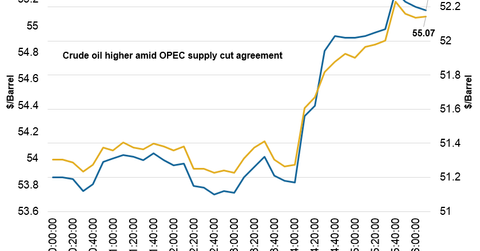

At 5:45 AM EST on December 5, the WTI crude oil futures contract for January 2017 delivery was trading at $52.18 per barrel—a rise of ~0.97%.

Nov. 20 2020, Updated 1:46 p.m. ET

Crude oil

Crude oil prices rose to the highest levels since May 2014 in the early hours on December 5. At 5:45 AM EST on December 5, the West Texas Intermediate crude oil futures contract for January 2017 delivery was trading at $52.18 per barrel—a rise of ~0.97%. The Brent crude futures contract for February 2017 delivery rose ~1.2% to $55.09 per barrel.

OPEC’s successful agreement to cut its production from 33.7 MMbpd (million barrels per day) to 32.5 MMbpd improved market sentiment. Prices are also supported by production cuts by non-OPEC members. Production cuts are expected to be 600,000 bpd (barrels per day). Russia, which is a non-OPEC producer, agreed to cut its production by 300,000 bpd. According to data released at end of last week, Russia’s daily oil production in November reached 11.21 MMbpd—the highest level in 30 years. On December 2, Baker Hughes reported an increase in US oil rigs by three to 477. The PowerShares Dynamic Energy Exploration & Production Portfolio (PXE) rose 0.21%, while the SPDR S&P Oil & Gas Exploration & Production (XOP) fell 0.12% on December 2.

Copper

Copper prices rose to the highest level since May 2015 in the early hours on December 5. At 6:00 AM EST on December 5, the COMEX copper futures contract for March 2017 delivery was trading at $2.66 per pound—a gain of ~1.4%. The rally in crude oil prices amid OPEC’s agreement for a supply cut supported copper prices. China’s stronger November manufacturing PMI also supported prices. Considering that China is the biggest copper consumer, China’s manufacturing, construction, and economic activities influence copper’s price and demand trends. The PowerShares DB Base Metals (DBB) fell 1.2%, while the SPDR S&P Metals & Mining (XME) rose 2.4% on December 2.

Precious metals

Gold (GLD) and silver fell in the early hours on December 5. At 6:00 AM EST on December 5, the COMEX gold futures contract for February 2017 delivery was trading at $1,166.65 per ounce—a fall of ~0.95%. The silver futures contract for March 2017 delivery fell ~1.1% to $16.64 per ounce. The firmer dollar in the early hours is weighing on gold prices. Recently, stronger US economic data increased the chances of an interest rate hike and took the shine out of safe-haven assets such as gold. Read How Much Could Gold React to Inflation? to learn about the gold market in relation to inflation levels. The platinum futures contract for January 2017 delivery was trading at $926.75 per ounce—a fall of ~0.64%. After touching fresh 2016 highs last week, palladium pulled back. At 6:10 AM EST, the palladium futures contract for March 2017 delivery was trading at $729.22 per ounce—a fall of ~2.2%.