Chesapeake Energy Announces Haynesville Asset Divestiture

Chesapeake Energy (CHK) announced on December 5 that it had agreed to sell 78,000 net acres in Louisiana’s Haynesville Shale for $450 million. The buyer is an undisclosed private player.

Dec. 6 2016, Published 4:24 p.m. ET

CHK’s Haynesville divestiture

In its 3Q16 earnings, Chesapeake Energy (CHK) had announced its plans to sell a portion of its Haynesville Shale properties by the end of 2016. Acting on that strategy, the company announced on December 5 that it had agreed to sell 78,000 net acres in Louisiana’s Haynesville Shale for $450 million. The buyer is an undisclosed private player.

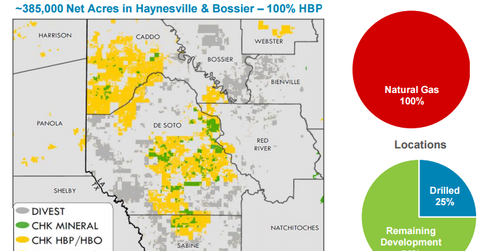

Of the 78,000 net acres, 40,000 net acres are considered to be CHK’s core acreage. The assets sold also include 250 wells, with current net production of ~30 million cubic feet of gas per day (or MMcfepd). As we can see in the image below, CHK’s Haynesville production mix is 100% natural gas (UNG).

Chesapeake Energy is also marketing another 50,000 net acres in the northeastern part of its Haynesville operations, and it expects to close the sale by 1Q17. After both Haynesville divestitures, CHK expects to retain ~250,000 net acres in the core of the Haynesville Shale.

Key players in the Haynesville Shale include BHP Billiton (BHP), EXCO Resources (XCO), and Goodrich Petroleum (GDP).

CHK’s plans for Haynesville in 2017

In 2017, Chesapeake Energy (CHK) plans to focus on longer laterals and enhanced completions in the Haynesville Shale, which it states could result in a “projected adjusted production growth of approximately 13%” in 2017 from its Haynesville operations.

The next part will talk briefly about CHK’s asset divestiture history.