What Do Analysts Think about Merck?

Wall Street analysts estimate Merck’s (MRK) top line will increase marginally by 0.1% to ~$10,546 million in 3Q17.

Oct. 25 2017, Updated 7:41 a.m. ET

Wall Street analyst estimates

Wall Street analysts estimate Merck’s (MRK) top line will increase marginally by 0.1% to ~$10,546 million in 3Q17. Also, the earnings per share are expected to come in at $1.03 for 3Q17.

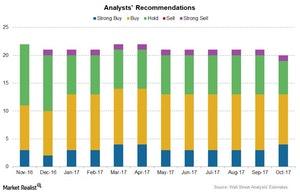

The above chart shows analysts’ recommendations over the last 12 months. The revenues for Merck are driven by key products including Gardasil vaccines and blockbuster drug Keytruda. However, drugs like Zetia, Vytorin, and Remicade are losing their market share to competition from other products on the market.

Analyst ratings

Merck’s stock price has risen nearly 3.6% over the last 12 months and ~7.7% in 2017 year-to-date. Analyst estimates show that the stock has the potential to return ~10.3% over the next 12 months. Wall Street analyst recommendations show a 12-month targeted price of $69.90 per share as compared to the last price of $63.40 per share as of October 23, 2017.

Analyst recommendations

As of October 24, 2017, there are 20 analysts tracking Merck. 13 analysts recommend a “buy,” six analysts recommend a “hold,” while one analyst recommends a “sell” for Merck. Changes in analyst estimates and recommendations are based on the changing trends in stock price and performance of the company.

The consensus rating for Merck stands at 2.25, which represents a moderate buy for both long-term growth investors and value investors.

The iShares Core High Dividend ETF (HDV) holds 3.3% of its total assets in Merck (MRK). HDV also holds 5.2% in Pfizer (PFE), 5.8% in Johnson & Johnson (JNJ), and 4.7% in Procter and Gamble (PG).