US Still the Largest Market for Novo Nordisk

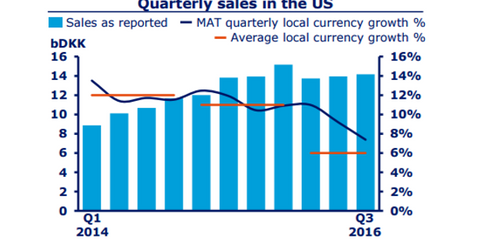

During 3Q16, Novo’s sales in the US rose 2% in local currency terms to 14.2 billion Danish kroner.

Nov. 1 2016, Updated 6:04 p.m. ET

Regional contribution

Novo Nordisk (NVO) records revenues from the following regional segments: US, Europe, International Operations, China, and the Pacific. With a ~51% share in total sales during the first nine months of 2016, the US remained the largest market for Novo followed by Europe, which had a ~19% share of total sales during the period. Novo dominates the global diabetes care market with a share of 27% in value terms. In this article, we’ll discuss the importance of the US in Novo’s success. The US held a 44% share in Novo’s overall growth during the first nine months of 2016.

Importance of US in Novo’s sales

During 3Q16, Novo’s sales in the US rose 2% in local currency terms to 14.2 billion Danish kroner. The strong growth of Victoza and Saxenda along with Tresiba supported growth in the region. Of Victoza’s sales growth, 77% came from the US. With increasing pricing pressure, Novo along with its peers Sanofi (SNY), Merck (MRK), and Eli Lilly (LLY) are poised to face a decline in diabetes drug sales.

In the US, Novo witnessed a decline in NovoLog and NovoLog mix. As noted by Novo, the major factors responsible for the fall were “lower prices, loss of contract with United Healthcare and a declining mix segment.” With increased competition in the US, Novo’s hemophilia portfolio faced a decline. However, the significant non-recurring positive adjustments to the Medicaid segment rebates for 2010 to 2015 did offset the fall during the first nine months of 2016.

If you want exposure to Novo but at the same time want to avoid excessive company-specific risks, you can invest in the PowerShares International Dividend Achievers Portfolio (PID). PID holds 0.85% of its total holdings in Novo Nordisk.