TSO to Acquire WNR: Where Do Their Valuations Stand?

In this article, we’ll look at Tesoro’s (TSO) and Western Refining’s (WNR) valuations following the news of TSO’s acquisition of WNR.

Nov. 18 2016, Updated 1:04 p.m. ET

TSO’s and WNR’s valuations

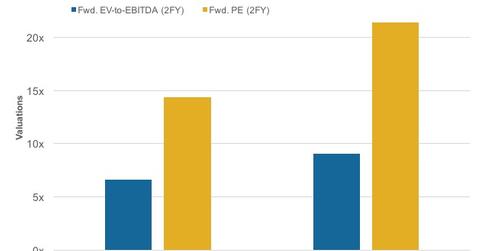

In this article, we’ll look at Tesoro’s (TSO) and Western Refining’s (WNR) valuations. Following the news of the acquisition, Tesoro’s forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) and price-to-earnings (or PE) stood at 6.6x and 14.4x, respectively, compared to Western Refining’s ratios of 9.1x and 21.4x, respectively.

WNR’s valuations are above the industry average forward EV-to-EBITDA of 7.3x and the industry average forward PE of 16.4x. The industry average considers nine American refiners, including Valero Energy (VLO), Phillps 66 (PSX), and Marathon Petroleum (MPC).

The forward EV-to-EBITDA and PE ratios show that WNR’s valuations are higher than TSO’s. This is likely because of a 23% rise in Western Refining’s stock following the acquisition news.

For exposure to refining stocks, investors can consider the iShares North American Natural Resources ETF (IGE). The ETF has ~6% exposure to refining and marketing sector stocks.