Do MLPs Benefit from the LP-GP Model?

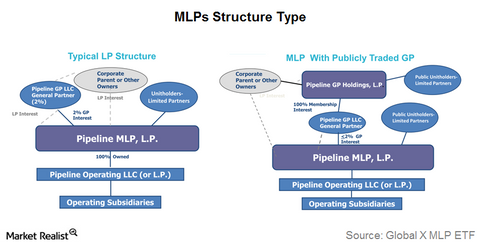

MLPs generally have an LP-GP (limited partner and general partner) model structure in which the LP is a publicly traded entity and owns the majority of the operating assets.

Nov. 28 2016, Updated 5:04 p.m. ET

LP-GP model

MLPs (master limited partnerships) generally have an LP-GP (limited partner and general partner) model structure in which the LP is a publicly traded entity and owns the majority of the operating assets.

A GP generally owns LP interest, GP interest, and IDRs (incentive distribution rights) in the LP. The GP manages the LP.

Some MLPs have their GPs publicly traded. These include the following:

- Energy Transfer Equity (ETE) and Energy Transfer Partners (ETP)

- Western Gas Equity Partners (WGP) and Western Gas Partners (WES)

Some MLPs have dropped the GP-LP model from their capital structures to reduce the cost of their equity capital. These partnerships include Enterprise Products Partners (EPD) and Buckeye Partners (BPL). Crestwood Equity Partners (CEQP) recently dropped the LP-GP model.

What are IDRs?

IDRs entitle a GP to receive additional cash after a minimum quarterly distribution and certain target distribution levels have been achieved. As distributions reach into higher tiers, incremental cash goes toward the payment of GP unitholders, affecting the cost of equity, or how much return unitholders demand.

The consequence of IDRs is that MLPs’ excess cash flows must grow at larger rates than their distributions to LP unit holders. For example, suppose an MLP with an IDR structure has reached the higher tier splits and would like to grow its distributions to its LP unitholders by 5%. In this case, the MLP must grow its available cash flow by more than 5%, because the GP owners will be taking a larger amount of the incremental cash flow growth.

Some GPs, including Energy Transfer Equity, have provided IDR subsidies to their LPs to support their balance sheets and growth capital expenditure plans in the current challenging price environment.

Benefits of the LP-GP model

The cost of capital for LPs is higher under the LP-GP model. At the same time, GPs are inclined to grow distribution at the partnership level, as their earnings are directly linked to distribution growth.