Is a Rerating of Airlines’ Valuation Multiple Possible?

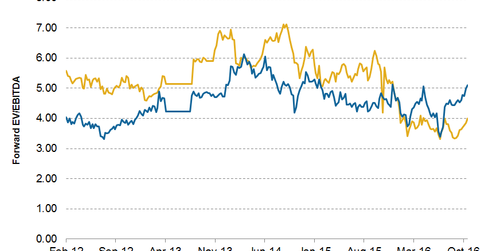

Currently, American Airlines (AAL), Southwest Airlines (LUV), and Alaska Air Group (ALK) are all trading at ~5x their forward EV-to-EBITDA multiples.

Nov. 20 2020, Updated 1:57 p.m. ET

Current valuation

Currently, American Airlines (AAL), Southwest Airlines (LUV), and Alaska Air Group (ALK) are all trading at ~5x their forward EV-to-EBITDA[1. enterprise value to earnings before interest, tax, depreciation, and amortization] multiples.

Delta Air Lines (DAL) and United Continental (UAL) are trading at ~4.7x their forward EV-to-EBITDA multiples. Spirit Airlines (SAVE) and Allegiant Travel (ALGT) are both trading at ~8x their forward EV-to-EBITDA multiples.

Why EV-to-EBITDA?

The capital-intensive airline industry has high levels of depreciation and amortization, as well as varying degrees of debt and operating leases. To neutralize these factors, we use the EV-to-EBITDA ratio to value airline stocks.

The forward EV-to-EBITDA ratio shows what investors are willing to pay for the next four quarters of estimated EBITDA.

Is a rerating possible?

According to Adam Hackel, an airline analyst at Imperial Capital LLC in New York, these airline industry investments are “really important for investor confidence.”

Savanthi Syth, a Raymond James Financial analyst, also voiced the same opinion. She noted that BRK-B’s investment indicates that the airline industry can demonstrate resiliency throughout an economic downturn, providing improving returns to shareholders. She stated, “It is likely to provide credibility to a potential re-rating of valuations closer to that of high-quality industrials in an era of stronger balance sheets and largely disciplined, through still highly competitive, behavior.”

However, investors should remember to do their own analysis before investing in airline stocks. Low fuel costs, high baggage fees, ancillary services revenues, and reduced competition have all worked in favor of the airlines for the past couple of years.

These conditions may not remain the same in years to come. If industry fundamentals deteriorate or if investors’ risk appetites fall, valuation multiples can fall too.

On the other hand, there may be catalysts for rerating. For example, a Trump presidency may actually be good news for airlines. Airlines have often cried foul over the unfair treatment meted out to Middle East carriers. If Trump actually implements some of his proposed trade measures, legacy carriers could benefit.

Also, with the recent labor contract negotiations, airlines seem to have bought labor peace for the next few years. Investors can gain exposure to airline stocks by investing in the SPDR S&P Transportation ETF (XTN), which invests 30.1% of its portfolio in airlines.