What Investors Should Know about JetBlue’s Debt

The airline industry is very capital-intensive, so airlines generally have huge debt numbers on their balance sheets.

April 27 2017, Updated 10:37 a.m. ET

Debt repayments

The airline industry is very capital-intensive, so airlines generally have huge debt numbers on their balance sheets. JetBlue is no exception. Throughout 2016, the airline repaid $443 million in regularly scheduled debt and capital lease obligations.

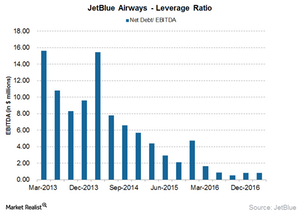

JetBlue has been focused on reducing its debt burden. Debt fell to $1.3 billion at the end of 1Q17 from $1.8 billion at the start of 1Q16. This decrease helped the airline bring down its total debt to EBITDA ratio from 1.64x at the end of 1Q16 to 0.83x at the end of 1Q17.

At the end of 1Q17, American Airlines’ (AAL) total debt-to-EBITDA ratio stands at 11.4x, United Continental’s (UAL) at 9.3x, and Delta Air Lines’ (DAL) at 3.2x. Other airlines have yet to report their 1Q17 earnings.

Strong cash flows help

JetBlue Airways Corporation (JBLU) ended the first quarter of 2017 with $1.1 billion in cash. The airline has been able to generate strong cash flows due to its exceptional operational performance. This strong cash flow generation should help reduce debt further.

Fleet growth postponed

To support its growth plans, JBLU planned on adding 30 new Airbus aircraft to its fleet. The delivery of the first 15 is expected in 2017–2019. It has now postponed some of the deliveries beyond 2020. This delay means more free cash flow will be available to investors in the next two to three years.

Investors can gain exposure to JetBlue stock by investing in the iShares S&P Mid-Cap 400 Value ETF (IJJ), which invests 0.99% of its portfolio in the stock.