Why Most Analysts Recommend a ‘Hold’ for Cloud Peak Energy

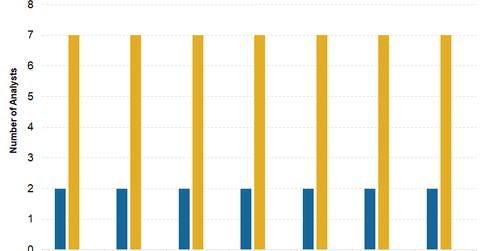

Of the nine analysts covering Cloud Peak Energy (CLD), seven analysts rated its stock as a “hold,” and two gave CLD a “buy” or “strong buy” rating.

Dec. 4 2020, Updated 10:53 a.m. ET

Analysts’ ratings

According to data compiled by Thomson Reuters, nine analysts are covering Cloud Peak Energy (CLD) stock. Of these analysts, seven (or 78.0%) analysts rated CLD stock as a “hold,” and two (or 22.0%) gave it a “buy” or “strong buy” rating. The company did not receive any “sell” or “strong sell” recommendations.

On October 24, 2017, Cloud Peak Energy’s consensus 12-month target price was $4.20, which reflects a downside potential of ~6.5% from its market price of $4.49.

The target price and return potential of CLD’s peers in the coal (KOL) industry follow:

Consensus estimates

Analysts expect Cloud Peak Energy to post muted 3Q17 earnings compared to 3Q16. These analysts expect the company to report an adjusted loss of $0.04 per share in 3Q17 compared to earnings per share of $0.04 in 3Q16. CLD reported an adjusted loss of $0.09 per share in 2Q17.

Notable ratings

On January 30, 2017, J.P. Morgan (JPM) upgraded Cloud Peak Energy (CLD) stock from “neutral” to “overweight.” JPM assigned a target price of $7.00 for the stock.

Brokerage firm Jefferies initiated coverage of Cloud Peak Energy stock on March 7, 2017, giving the stock a “hold” rating and a target price of $5.00.

In the next part of this series, we’ll examine analysts’ estimates and see whether these ratings are optimistic.