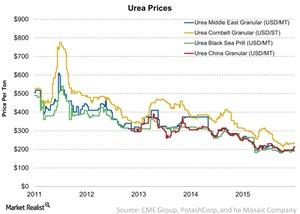

Did Capacity Shutdowns in China Impact Urea Prices?

For the week ending October 28, the overall movement in urea prices was flat to positive. Granular urea prices rose 6.6% to $211 per metric ton in China.

Dec. 4 2020, Updated 10:53 a.m. ET

Urea prices

For the week ending October 28, the overall movement in urea prices was flat to positive at the four locations discussed below. Nitrogen investors (MOO) want to see more positive movements in fertilizer prices. Remember, urea is upgraded from ammonia. As a result, it’s important to watch any movement in ammonia prices.

Granular urea

Granular urea prices rose 6.6% to $211 per metric ton in China—compared to $198 per metric ton two weeks ago. Average weekly urea prices in the Middle East rose 4.7% to $212 per metric ton from $202 per metric ton two weeks ago. Over the same time, average weekly prices in the Corn Belt region of the US also rose 1.7% to $213 per metric ton. Overall, granular urea prices rose 5% last week at the above three locations.

Recently, CF Industries (CF) showed that several Chinese anthracite-based producers closed their operations due to the higher production costs. It lifted urea prices, as you can see in the above chart. It gave nitrogen producers hope such as CF Industries, Terra Nitrogen (TNH), CVR Partners (UAN), and PotashCorp (POT).

Granular urea prices at the above three locations fell 18% YoY (year-over-year).

Prilled urea

Prilled urea’s average weekly prices moved sideways to $190 per metric ton at the Black Sea location for the week ending October 28. Granular urea prices at the above three locations fell 25% YoY.

Next, we’ll discuss natural gas—the key input material required for nitrogen fertilizers.