Shareholder Buyback: A Powerful Tool to Achieve Higher Income

What products single out specifically the share buyback companies?

Oct. 4 2016, Updated 10:05 a.m. ET

Market Realist: Interesting, so for investors, do you differentiate between share buybacks and just dividend achievers as people recognize that as a yield strategy? What products single out specifically the share buyback companies?

Dave: From the Achievers brand and family, we have a separate and distinct setup of dividends, companies that are paying cash back every year, vs. the buyback side of companies that are reducing their shares. On the buybacks (PKW) side, we’ve done a lot of research and we construct this by looking at net reduction in shares over a calendar year. If a company has reduced their shares by 5% or more, then it is included in the index. We look at this and we see that buybacks have a short-term boost in terms of company share price. 5% is a strong number above the noise of retiring of options or retiring of PSUs (performance stock units) or RSUs (restricted stock units), and it shows the company has a plan to reduce their overall float in the marketplace.

Similar to Dividend Achievers, you’re filtering out from 2,800 or 3,000 names, anywhere now down to 200 names. There’s pretty heavy turnover, as there should be, since if a company were to reduce their shares by 5% every year, eventually they would disappear. So companies don’t do that. But while they want to stay public, they also want to make sure that they’re advancing their shareholder cause. So we do view the buybacks side as separate from dividends, and we do view it as a powerful way of really giving a tax avoided return to the shareholder. Because rather than the shareholder being compensated via cash, they’re being compensated via higher earnings or higher share of company’s net income. We’ve seen a lot of interest in this over the years as a way of participating in shareholder policies but without the tax consequences.

Market Realist: How do you think investors should think about choosing between a share buyback product vs a dividend product?

Dave: Well there are a number of different factors that would go into that. One, companies that have higher degrees of buybacks tend not to have a higher degree of dividends, and vice versa. And so if an investor is looking for dividends, clearly the dividend story would be one that is more applicable to their situation. Another benefit with Dividend Achievers is an increased expectation of future growth from a capital return perspective, while the expectation of price growth would be higher on the Buybacks side. The other option seeks to combine the two. We evaluate companies and try to find best of breed between these two return types; we call this our Shareholder Yield brand. This combines companies with high, sustainable dividends with companies that have been reducing their shares over the year to create a unified strategy that is the best of both worlds.

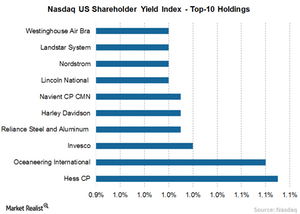

Market Realist’s View: The Shareholder Yield Index

The Nasdaq US Shareholder Yield Index comprises companies within the Nasdaq US Large Mid Cap Index that exhibit high degrees of sustainable shareholder yield. The financial sector is the largest constituent (26.9%) of the index, followed by consumer services (23.4%), industrials (17.1%), consumer goods (7.3%), and healthcare (6.8%)(IYH). The index comprises 137 companies with weights ranging from 0.44% to 1.09%. Hess CP and Oceaneering International are the largest constituents of the index at 1.1% each, trailed by Invesco (IVR), Reliance Steel and Aluminum, and Harley Davidson at 1% each.

Market Realist: Do you want to add anything about your Dividend Product before we move onto AlphaDEX?

Dave: I think the broad dividend suite that Nasdaq has developed over the years is just that, a nice and diversified suite of indexes tracking various dividend-focused strategies. We have a lot of different strategies that are designed for different purposes on the income spectrum. I think it’s important to understand that investors have different needs. When I talk to folks about Dividend Achievers, I really look at that as a core replacement concept, that you can go out and buy an ETF tracking a Dividend Achievers index and use that instead of the S&P 500, because there’s a very high degree of beta, you’re getting broad market exposure, but you’re also tilting yourself now to one of the most powerful return factors that we know of, which is dividends. You’re also defending yourself against rising rates or potential for inflation and things along that line. Generally speaking, you’re going to be really highly correlated to the market. Then we have other strategies that are more tilted towards high yield or high current income. So there are strategies developed across the board to serve a lot of different needs.