How Does the RBI See Food Inflation Panning out in India?

Components of inflation While food inflation in India has been pushing retail inflation up, fuel inflation (BP) (STO) (RDS.B), another important component, has been subdued. According to the October monetary policy statement issued by the RBI (Reserve Bank of India), “Fuel inflation has moderated steadily through the year so far.” The RBI has also announced […]

Oct. 5 2016, Updated 4:41 p.m. ET

Components of inflation

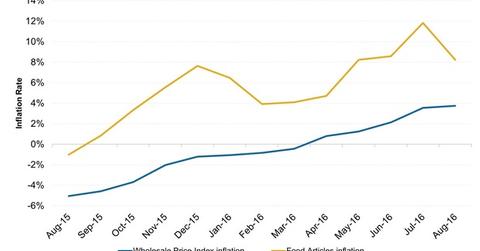

While food inflation in India has been pushing retail inflation up, fuel inflation (BP) (STO) (RDS.B), another important component, has been subdued. According to the October monetary policy statement issued by the RBI (Reserve Bank of India), “Fuel inflation has moderated steadily through the year so far.”

The RBI has also announced that core inflation, which excludes fuel and food prices from calculations, has stayed around the 5% mark “mainly in respect to education, medical and personal care services.”

Outlook for food inflation

Given that food inflation has been a key driver of the rise in retail inflation in India in 2016, and its importance for inflation as laid out in the previous article, it becomes imperative to understand the path of food inflation.

The monetary policy committee of the RBI expects food inflation outlook to improve because of “strong improvement in sowing, along with supply management measures.” The committee is confident that the sharp decline in retail inflation in August is indicative of a decline in the momentum of food inflation.

This trend is important because favorable base effects (see previous article) wear off with time, and a decline in food prices is the only sustainable method of ensuring that overall retail inflation remains under control.

The committee also noted the efforts of the central government to control food inflation by undertaking food supply management, especially with regards to pulses. These efforts should also help in reducing the pace of food inflation going forward, as noted by the committee.

Although the committee continues to see risks to inflation “tilted to the upside,” it appears that those risks are lower than the second and third bimonthly monetary policy statements issued in June and August respectively. A sustained decline in inflation may help consumer spending, and thus the revenues of Indian corporations, which should feed into India-focused funds (MINDX) (PIN) as well. It would also give the RBI more room to ease its monetary policy stance.

Still, better monetary policy transmission is still a challenge, though the RBI feels that banks now have an impetus to reduce rates further. We’ll take a closer look at this factor in the next part of the series.