How Much Is the Return Opportunity for Novo Nordisk in 3Q16?

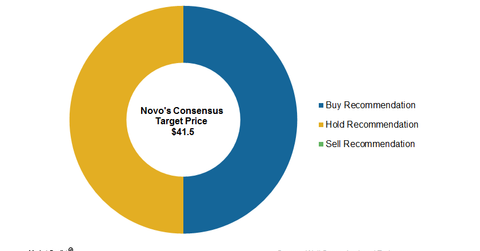

A Bloomberg survey of two brokerage houses on October 24, 2016, reflected a 50% “buy” rating and a 50% “hold” rating for the stock.

Oct. 25 2016, Published 10:52 a.m. ET

Share price recommendations

Novo Nordisk (NVO) will its release earnings for 3Q16 on October 28, 2016. A Bloomberg survey of two brokerage houses on October 24, 2016, reflected a 50% “buy” rating and a 50% “hold” rating for the stock.

The consensus 12-month target price for Novo is $57. This translates to a ~37.3% return compared to its closing price of $41.4 on October 21, 2016.

With increased pricing pressures, Novo’s PE (price-to-earnings) multiple has fallen to 15x of its forward earnings. However, over a long-term period, its promising pipeline may overcome these challenges, and its share price could jump.

What analysts are suggesting for Novo’s peers

According to a Bloomberg survey of 26 analysts on October 24, 2016, 80.8% of analysts issued “buy” ratings for Eli Lilly and Company (LLY), while 19.2% rated the stock as a “hold.” With a consensus price of $98.15, Eli Lilly has the opportunity to earn 25.4% over a one-year period on its closing price of $78.25 as of October 21.

According to the ratings of 24 analysts in a Bloomberg consensus dated October 24, 2016, 50% called Merck & Co. (MRK) a “buy,” while 50% suggested a “hold” on the stock. Merck’s consensus price of $67.75 presents an upward potential of 10.7% over a 12-month period compared to its closing price of $61.20 as of October 21.

A Bloomberg consensus of five analysts on October 20, 2016, indicated that 60% had issued “buy” ratings on Sanofi (SNY), and 40% had recommended “holds.” With a consensus target price of $48, Sanofi has an opportunity to earn 27.2% on its closing price of $37.75 as of October 21.

Any direct investment in equities is highly risky. If you’re a risk-averse investor, you may want to invest in ETFs. The PowerShares International Dividend Achievers ETF (PID) has 0.97% of its total holdings in Novo Nordisk.

Continue to the next article for a discussion on analysts’ revenue growth expectations from Novo in 3Q16.