This Is Barrick Gold’s Focus: To Improve Free Cash Flow

Barrick Gold’s (ABX) management has defined value creation for shareholders in terms of FCF (free cash flow) per share.

Feb. 20 2017, Updated 10:37 a.m. ET

Focus on free cash flow

Barrick Gold’s (ABX) management has defined value creation for shareholders in terms of FCF (free cash flow) per share. The company intends to maximize FCF by allocating capital to opportunities that offer the highest returns. It defines its strategic focus as meeting a hurdle rate of 15.0% at a gold price of $1,200 per ounce.

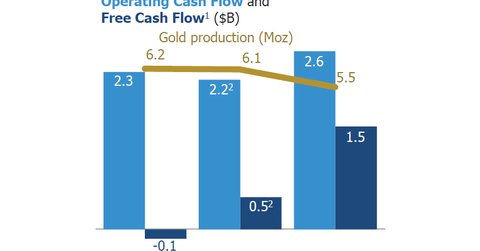

Barrick Gold delivered FCF of $385.0 million in 4Q16 and $1.5 billion in 2016. FCF in 2016 was at a record level of annual value for the company. The fourth quarter also marked the seventh consecutive quarter of positive FCF.

It’s worth noting that this FCF improvement is in spite of lower production due to non-core asset sales. Higher gold prices as well as the company’s continued focus on costs helped FCF generation.

Increasing dividend

On the back of its solid fundamentals, Barrick Gold had decided to raise its dividends from $0.02 per share to $0.03 per share.

Break-even FCF

At the current high gold prices, many gold miners are generating FCF. But Barrick Gold is targeting a break-even FCF even when gold prices are at $1,000 per ounce in 2017.

The company noted in its press release that its expectations of growing FCF per share are based on the following foundations:

- core mines, which are long-life and low-cost operations

- the largest gold reserves and resources in the industry

- exploration programs with a track record of creating value

- potential to improve the overall quality of its portfolio through acquisitions and partnerships

Barrick Gold’s peers

Other gold miners, including Eldorado Gold (EGO), AngloGold Ashanti (AU), Goldcorp (GG), Yamana Gold (AUY), and Newmont Mining (NEM), are also taking steps to increase their FCFs to weather this volatile gold price environment.

You can gain exposure to the gold sector by investing in the VanEck Vectors Gold Miners ETF (GDX), which invests in intermediate and senior gold producers. Goldcorp makes up 7.6% of GDX’s holdings. The SPDR Gold Shares (GLD) tracks spot gold prices.