Assessing the Paradigm Shift in the Fiscal Policy

Fiscal policy has turned more expansionary, with stress on fiscal spending and monetary easing, thereby flooding the financial markets worldwide with huge liquidity.

Oct. 17 2016, Updated 6:51 p.m. ET

Policymakers are changing their tone on fiscal policy. Jean assesses the potential for more fiscal support in key economies, as well as the impact on global growth and asset prices.

Policymakers are changing their tone on fiscal policy. More governments are now looking at fiscal support, and the focus on austerity has faded as monetary easing reaches its limits.

The shift away from austerity and the acknowledgement of the need for fiscal and monetary coordination matter for financial markets. In our inaugural Global Macro Outlook, we assess the potential for more fiscal easing in key economies, and gauge the impact on global growth and asset prices.

Market Realist – Policymakers’ shifting stance

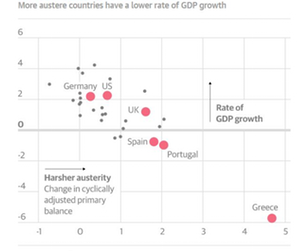

After several years of austerity measures introduced to restrict budget deficits to a comfortable level and to rein in rising government debt, the fiscal stance in the developed world (EFA) (IEFA) has reversed in recent years, especially after the great financial crisis.

The shift in monetary policy was necessitated due to the failure of austerity measures to bring positive changes to the economy. Many years of subdued growth and lower inflation, or deflation in many cases, are the main drivers for the fiscal policy turnaround.

Expansionary policies

Fiscal policy has turned more expansionary, with stress on fiscal spending and monetary easing, thereby flooding the financial markets worldwide (ACWI) (SCZ) with huge liquidity. The main intention behind the aggressive fiscal easing is to prop up consumer spending (IYC), which is ultimately expected to boost economic growth.

Wider acceptance

Many governments around the world have accepted the policies of monetary easing and lower interest rates as a way to ramp up growth. A look at the global credit market shows that the average yield on global government bonds of all maturities is currently ~0.9%, which is well below the ten-year average of 2.3%.

In this series, we’ll assess the potential of further easing in developed markets and its impact on the financial markets worldwide.