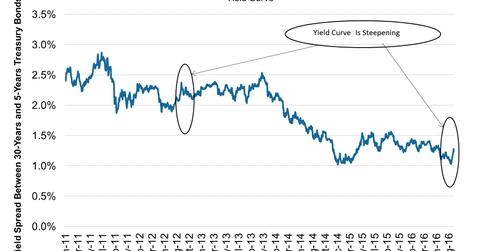

Yield Curve Is Steepening: What Does It Indicate for the Market?

In this series, we’ll compare yields across various developed markets (EFA) (VEA). We’ll also look at how a steepening yield curve affects the financial sector (XLF).

Sept. 21 2016, Updated 1:57 p.m. ET

Yield curve

The spread between the US 30-year Treasury bond and the five-year Treasury bond yield widened 1.3% on September 15, 2016. The spread rose to its highest level since June 30, 2016. The spread rose consecutively for the last nine trading sessions ending on September 15.

The spread indicates that market participants expect that the Fed might hold the key interest rate steady. When the probability is likely for a constant interest rate (QQQ), investors generally prefer short-term bonds (SHY) compared to long-term bonds (TLT) (IEF). So the yield spread between 30-year and five-year Treasury bonds rises.

What the yield curve is indicating

The spread rebounded from its low, which occurred in December 2014, before rising for the last nine trading sessions ending on September 15, 2016. Notably, the Fed ended its quantitative easing in October 2014. Since October 2014, the spread has been moving within a narrow range of 1% to 1.5%.