What’s Bank of America’s Interest Rate Risk?

Bank of America (BAC) is extremely sensitive to interest rate changes. Its latest 10-Q filing shows that its asset sensitivity has risen in 2Q15.

Sept. 27 2016, Updated 8:05 a.m. ET

BAC’s interest rate exposure

Bank of America (BAC) is extremely sensitive to interest rate changes. Its latest 10-Q filing shows that its asset sensitivity has risen in 2Q16, driven by lower long-term rates and rises in estimated deposit growth.

Further, BAC’s income is far more sensitive to falls in interest rates than its peers Wells Fargo (WFC), JPMorgan Chase (JPM), and Citigroup (C).

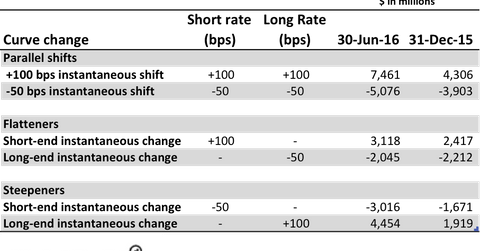

As seen in the table above, a parallel 100-basis-point rise in interest rates would lead to a $7.5 billion rise in BAC’s net interest income, nearly 70% higher than the $4.3 billion estimated in December 2015. In 2Q16, Bank of America reported net interest margins of 2.0%, 34 basis points lower compared to a year ago.

Further, its net interest income fell 15% to $9.4 billion. Net interest income forms ~50% of the company’s total income and is one of the largest sources of revenue for the company.

Bank of America has one of the largest loan portfolios in the financial sector (XLF), making its earnings extremely sensitive to interest rates. In 2Q16, it had a loan portfolio worth $903 billion. By comparison, Citigroup had a loan portfolio of $592 billion, while Wells Fargo had loans of $951 billion.