Teva Is Well Positioned for New Trends in the US Generic Market

Because of its drug portfolio, manufacturing operations, and customer relationships, Teva expects to benefit from new trends in the US generic market.

Sept. 27 2016, Published 6:10 p.m. ET

New trends in the US generic market

Because of its broad drug portfolio, extensive manufacturing operations, and strong customer relationships, Teva Pharmaceutical Industries (TEVA) expects to benefit from the new trends in the US generic marketplace. These trends could help the company pose strong competition to other generic players such as Mylan (MYL), Perrigo (PRGO), and Pfizer (PFE).

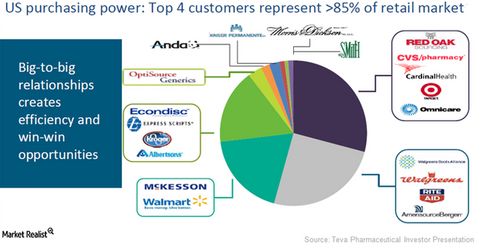

Buyer consolidation

The above diagram shows the players in the retail generics market in the United States. Of these, Walgreens Boots Alliance, Red Oak Sourcing, Econdisc Contracting Solutions, and the new McKesson-Walmart combination account for more than 85% of the market share in the United States. They’re also Teva Pharmaceutical’s four key customers.

Despite consolidation trends among Teva’s customers, Teva may not suffer due to buyers’ increased bargaining power. This is mainly due to the large size of the company, its global nature, and its presence in multiple geographic markets. This can help Teva as well as its customers realize large operational and administrative efficiencies. The big-to-big transaction is thus expected to prove beneficial for all participants.

If Teva doesn’t face pricing pressures despite buyer consolidation due to its well-aligned strategy, the company’s share price may rise. It may also benefit the VanEck Vectors Pharmaceutical ETF (PPH). Teva Pharmaceutical makes up about 4.3% of PPH’s total portfolio holdings.

Supply chain disruptions

The FDA (U.S. Food and Drug Administration) has been regularly reviewing the active pharmaceutical ingredients (or APIs) and finished dosage facilities of pharmaceutical players. Unlike other generic players who are seeing breakdowns in their supply chains, Teva Pharmaceutical has managed to deal with this issue due to its optimal cost structure and manufacturing flexibility.

Pricing pressures

A broad product portfolio and a robust research pipeline in the generic business are expected to help Teva Pharmaceutical limit the impact of pricing fluctuations. The company expects to launch 68 new products in 2016 and more than 80 products in 2017.

In the next part of this series, we’ll explore the market opportunity for Teva Pharmaceutical in the generic pharmaceutical industry in the European Union.