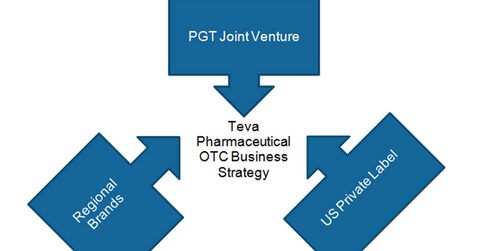

Teva’s OTC Business Is Playing out to Be a Key Growth Driver

In addition to its generic pharmaceutical business, Teva Pharmaceutical also has a significant presence in the major categories of the OTC drug business.

Sept. 27 2016, Updated 11:04 a.m. ET

OTC business trends

In addition to its generic pharmaceutical business, Teva Pharmaceutical Industries (TEVA) also has a significant presence in the major categories of the OTC (over-the-counter) drug business. The global OTC business is growing annually at about 6%.

Teva is expected to witness growth in sales due to favorable trends in its OTC business, which could boost the company’s share prices. Notably, the Vanguard FTSE All-World ex-US ETF (VEU) has about 0.50% of its total portfolio holdings in TEVA.

PGT joint venture

On November 03, 2011, Teva and Procter & Gamble (PG) entered into a joint venture agreement in the consumer healthcare business. This joint venture has helped Teva position itself in the cough and cold space as well as in the vitamins and minerals segment under the brand names Vicks and Swisse, respectively.

The joint venture is mainly focused on offering company-branded OTC drugs in European markets. The drugs are commercialized either under the Teva brand or under the Ratiopharm brand in Germany. The joint venture with Procter & Gamble, a leader in OTC drug business, has helped Teva give tough competition to other OTC players like Perrigo (PRGO), GlaxoSmithKline (GSK), and Johnson & Johnson.

Regional brands

Teva has acquired an OTC drug portfolio worth $200 million–$300 million through the acquisition of Allergan’s generics business. These drugs won’t be included in the joint venture with Procter & Gamble and will be marketed under the Teva brand name. However, the company can leverage the sales teams of its joint venture to ensure smooth operations for the newly acquired OTC portfolio.

Teva’s acquisition of Allergan’s generics business has added well-known drugs such as Sudocrem, the most popular diaper rash drug in the world, and Troxivan, the biggest OTC brand in Russia, to its portfolio. The company is thus well placed to leverage synergies between its generic, specialty, and OTC business in 2016.

US private labels

Teva has meanwhile managed to penetrate the as-yet-unexplored US private label business, mainly through drugs obtained from Allergan. These drugs are already being commercialized in the US under private labels such as CVS, Walgreens, and Rite Aids. Teva has also been the first company approved to market two big OTC brands in the US, Nexium OTC and Nicoderm CQ.

In the next part, we’ll explore Teva Pharmaceutical’s biosimilar business in greater detail.