How Gilead Dominates the HCV Space

In January 2012, Gilead Sciences (GILD) acquired Pharmasset and got access to sofosbuvir. In December 2013, the FDA approved sofosbuvir under the brand name Sovaldi.

Sept. 26 2016, Updated 8:06 a.m. ET

The journey of the HCV franchise

In January 2012, Gilead Sciences (GILD) acquired Pharmasset and got access to sofosbuvir. Later, in December 2013, the FDA (U.S. Food and Drug Administration) approved sofosbuvir under the brand name Sovaldi. Sovaldi won approval in the European Union in January 2014.

In October and November 2014, Harvoni, a combination of ledipasvir and sofosbuvir, was approved by the FDA and the European Union. The launches of Sovaldi and Harvoni in Japan took place in May and September 2015, respectively.

The United States is a significant market for a Sovaldi-based regimen since it includes ~46% of the total HCV-treated population.

This journey of value additive products continued with Epclusa, which is a combination of sofosbuvir and velpatasvir. The FDA approved Epclusa on June 28, 2016, and the drug won approval from the European Commission in July 2016. Epclusa’s pricing and reimbursement process in Europe will take another 12 months. It’s indicated for any of the six genotypes of hepatitis C and is priced lower than Harvoni and Sovaldi.

Gilead’s costly HCV drugs

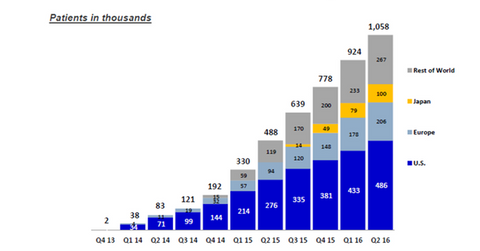

Gilead’s HCV franchise has been part of a pricing debate. Despite being costly, a Sovaldi-based regimen has treated more than a million HCV-infected patients. The strong value proposition offered by the drug has supported its pricing. Other costlier drugs include BioMarin’s (BMRN) Naglazyme and Vimizim, Alexion Pharmaceuticals’ (ALXN) Soliris, and Shire’s (SHPG) Elaprase.

To sustain the challenging pricing and reimbursement environment in the United States, companies are increasing rebates and discounts for their products. These offers result in lower sales.

To avoid the ups and downs of Gilead’s stock price, you could choose to invest in the iShares S&P 500 Growth (IVW). Gilead accounts for 1.1% of IVW’s total holdings.

In the next part of the series, let’s take a look at Gilead’s HIV (human immunodeficiency virus) franchise.