Cleaner Natural Gas Production Continuing to Hurt Coal Miners

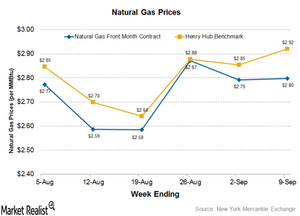

Henry Hub benchmark natural gas prices came in at $2.92 per MMBtu for the week ended September 9, 2016, compared to $2.85 per MMBtu for the previous week.

Sept. 16 2016, Updated 4:04 p.m. ET

Natural gas prices

Henry Hub benchmark natural gas prices came in at $2.92 per MMBtu (million British thermal units) for the week ended September 9, 2016. This compares to $2.85 per MMBtu for the previous week. Natural gas futures prices also rose marginally to $2.80 per MMBtu for the week ended September 9, from $2.79 per MMBtu for the previous week.

Lower-than-expected natural gas inventory additions helped natural gas spot prices rise nearly 1% on NYMEX (New York Mercantile Exchange) to close at $2.92 on September 15, 2016.

Why are these indicators important?

As most of us know, the shale gas boom across the United States has led to a massive rise in natural gas production. This spurred a fall in natural gas prices. As a result, natural gas became a strong competitor of coal, particularly in 2015. Cleaner, more competitive natural gas has eaten away at the market share of coal in electricity generation, which is a continuing trend.

As we saw in the first part of this series, natural gas prices and coal’s market share in electricity generation are closely related. When natural gas prices rise, coal gains market share because it becomes more economical for utilities to use coal for power generation. On the other hand, a fall in natural gas prices generally leads to a fall in coal’s market share.

Impact on coal and utilities

A rise in natural gas prices can benefit coal producers (KOL) such as Alliance Resource Partners (ARLP) and Natural Resources Partners (NRP). However, the current prices are still at multiyear lows.

For utilities (XLU) such as Dynegy (DYN) and NRG Energy (NRG), the impact depends on the level of regulation. For regulated utilities, the impact is generally negligible because the cost of fuel is part of tariff calculations. On the other hand, unregulated electricity prices are falling due to weak fuel prices, putting pressure on unregulated power producers.

Next, let’s look at crude oil prices and their impact on coal producers.