Marathon Oil’s 2Q16 Operating Netbacks Unveiled

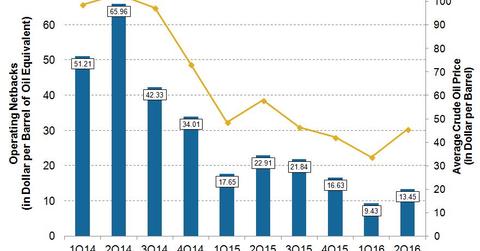

In 2Q16, Marathon Oil (MRO) reported an operating netback of ~$13.45 per boe (barrel of oil equivalent), which is ~41% lower than in 2Q15.

Dec. 16 2016, Updated 1:38 p.m. ET

Marathon Oil’s operating netbacks

In 2Q16, Marathon Oil (MRO) reported an operating netback of ~$13.45 per boe (barrel of oil equivalent), which is ~41% lower than in 2Q15.

Operating netback (also referred to as production netback) is the oil and gas revenue realized per boe (barrel of oil equivalent) after all the costs to bring one barrel of oil equivalent to the marketplace are subtracted from the realized price. Operating netback is derived by subtracting field operating expenses (or production expenses), production taxes, and transportation expenses from the realized price, including hedging benefits.

Other upstream players

By comparison, in 2Q16, S&P 500 (SPY) upstream companies ConocoPhillips (COP), Pioneer Natural Resources (PXD), and Murphy Oil (MUR) had operating netbacks of $26.34 per boe, $39.24 per boe, and $16.77 per boe, respectively.

In the next and final part of this series, we’ll take a look at MRO’s implied volatility.