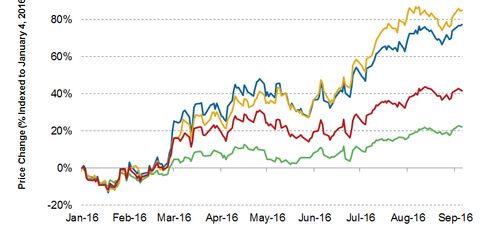

The iShares MSCI Brazil Capped ETF (EWZ) is up 77.3% year-to-date (or YTD), while the iShares MSCI Brazil Small-Cap ETF (EWZS) has risen by 85% YTD as of September 8, 2016. The IBOVESPA Index recorded a YTD growth of 42.9% as of September 8. The excellent returns were probably reflecting the market’s confidence due to the change in leadership and the IMF expectations, which we’ll discuss later. The confidence in Brazil was also evident in the outlook for the emerging markets (EEM) and the Latin American and the Caribbean regions, which we’ll also discuss later.

Impeachment and its mixed repercussions

Michel Temer, interim President since May 2016, took over when Dilma Rousseff left on August 31, 2016. Dilma Rousseff was impeached on charges of manipulation of the country’s budget funds in an effort to conceal the nation’s rising economic snags. At present, Brazil is also reeling under the pressure of rising consumer prices, slower GDP growth, rising debt levels, and unemployment. The burgeoning prices of the ETFs and indexes reflected investor confidence due to the change in leadership and the potential recovery of one of the largest economies. The unchanged Selic rate and the IMF’s optimistic outlook towards Brazil also had a lot to do with the returns.

Brazil versus Latin America: A brief background

Latin America has been struggling with rising volatility and commodity prices since 2015. The Brexit fear further added to concerns over instability in terms of growth, monetary policy, and asset prices in 2Q16. The Latin American and the Caribbean countries have been rendered vulnerable by the past five years of “great deceleration.” The commodity exporting countries and their increased financial integration have made the region susceptible to the worldwide boom and bust cycles. Further, the unstable commodity prices coupled with the external factors have wreaked havoc on the GDP growth of the region.

Recession in Latin America

The IMF has projected that the Latin American economy will fall 0.5% in 2016, marking two consecutive years of negative growth for the economy since the Latin American debt crisis of the early 1980s.

The countries facing an output contraction include Brazil, Chile, Venezuela, and Argentina. On the other hand, the condition of Peru has improved driven by mining investments. The growth prospects of Mexico and Central America seem pretty decent due to the recovery in the US. The tourism-driven countries in the Caribbean are doing well. The IMF also expects the economy to bounce back in 2017 with a growth rate of 1.5% once the countries facing recession recover. The iShares Latin America 40 (ILF) was up by 41.6% as of September 8, 2016.

IMF outlook

The IMF maintains a relatively positive outlook for Mexico and Brazil driven by the US recovery. Mexico’s growth rate is expected to remain flat at 2.5% in 2016. Brazil’s growth is expected to dip by 3.3% in 2016. The Latin America and Caribbean region is expected to report a decline of 0.4% in 2016 against a flat growth rate in 2015. The World Bank and the IMF’s lower forecasted growth rates in the region is mainly due to the slowdown in Brazil. In the rest of this series, we’ll look at other factors that may affect Brazil’s outlook going forward.