Heidi Richardson

Heidi Richardson is a Global Investment Strategist for BlackRock. She is responsible for relating the Investment Strategy Team’s research and investment views to a wide variety of investors. She joined the firm in 2010 with twenty three years of active investment experience across both equities and fixed income. She writes about how to implement BlackRock’s best investment ideas.

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of BlackRock.

More From Heidi Richardson

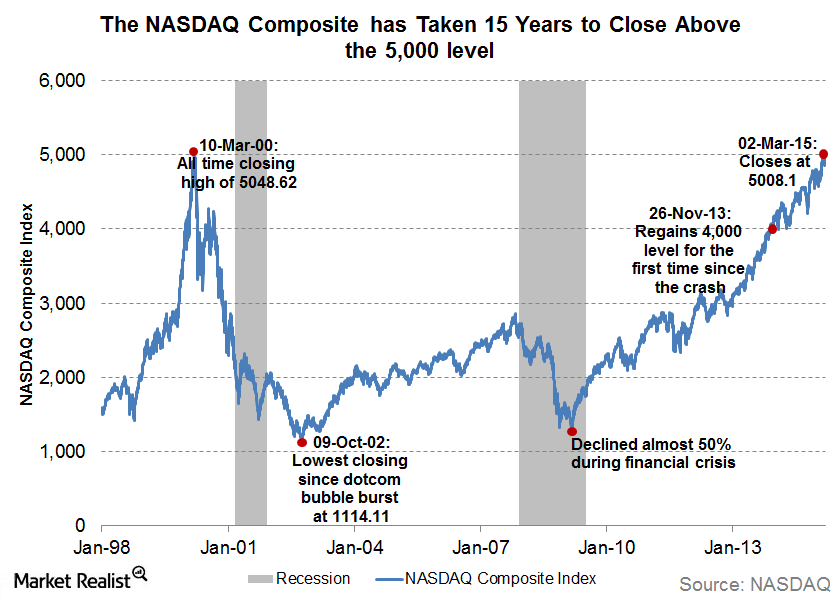

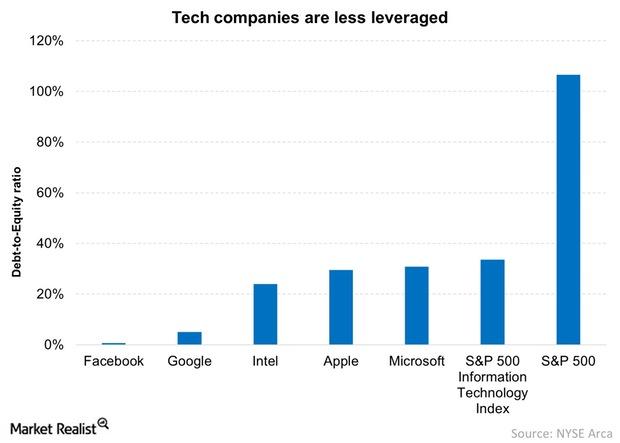

Why the NASDAQ’s 5,000 Level Is Not Like the Dot Com Bubble

The NASDAQ hit the all-important 5,000 level on March 2, 2015, for the first time after the dot com bubble burst of 2000.

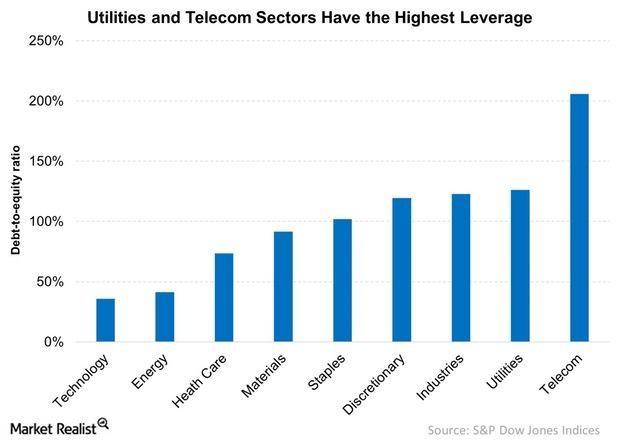

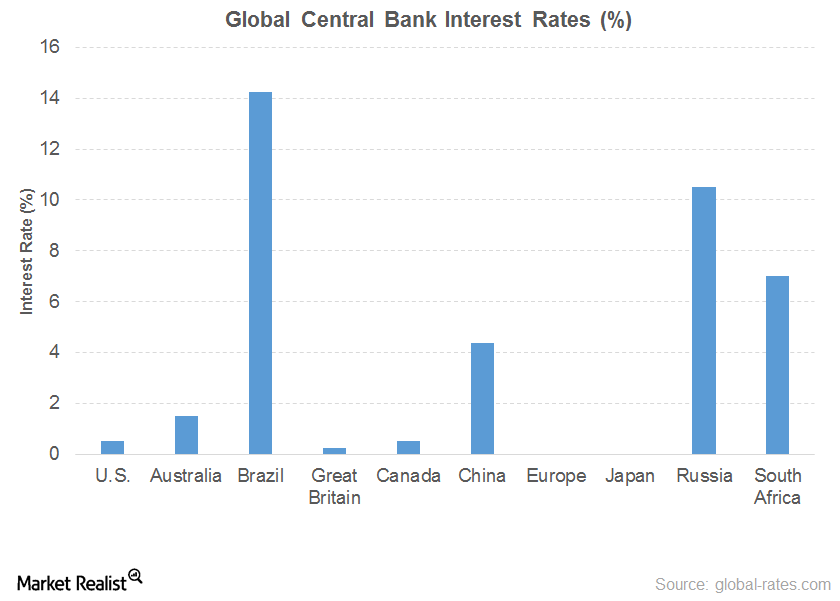

How a Rate Hike Could Affect High-Leverage Sectors

Industrials, utilities, and telecommunications have much higher leverage, as these sectors have massive capital needs.

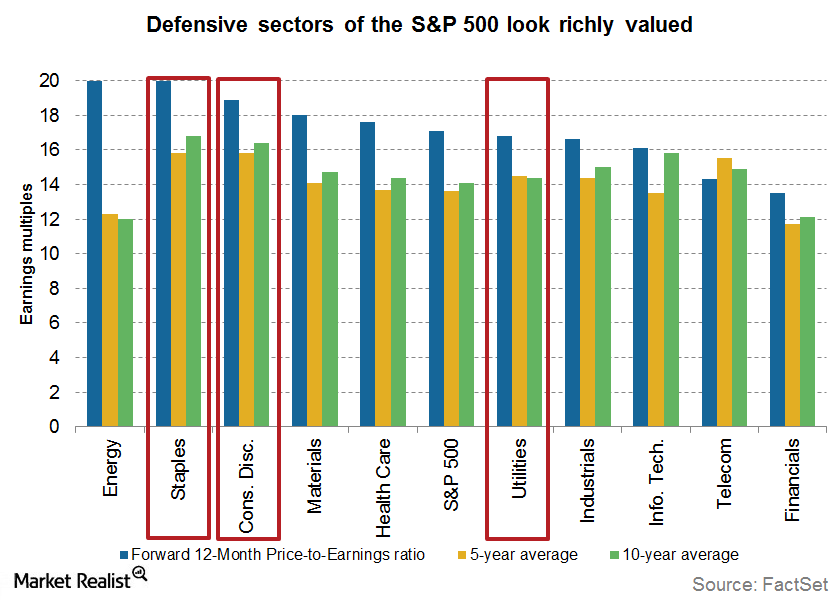

Why Cyclical Momentum Favors The Tech Sector

Cyclical momentum favors the tech sector. Economic growth favors cyclical stocks like technology. The tech sector invests in a lot of R&D.

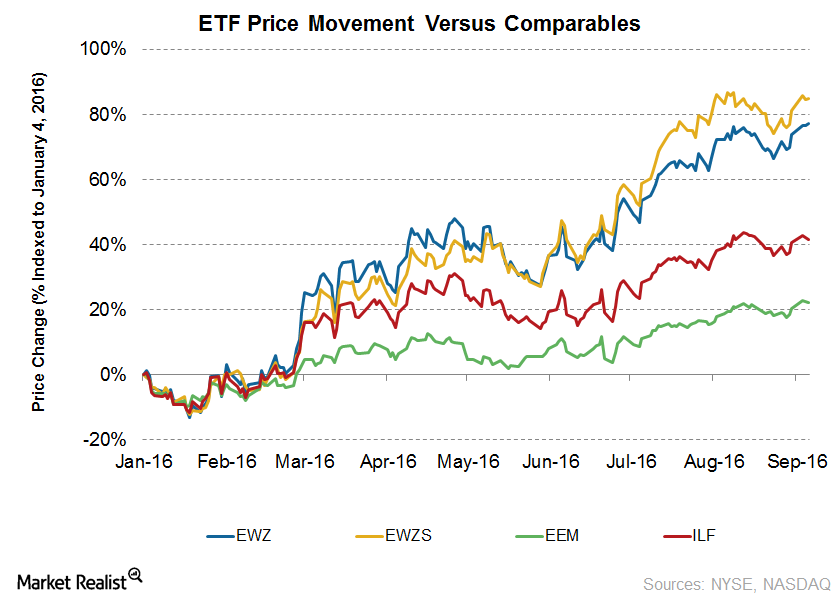

Is It Raining Gold for Brazil?

Brazil’s performance in the 2016 Rio Olympics and worldwide speculation about a Fed rate hike might have a role to play in the country’s stock market performance in fiscal 2016.

Does Brazil’s Industrial Production Data and Selic Rate Ring a Bell?

First the good news: After two years of a deep recession, the economic fundamentals of Brazil are showing signs of bottoming out. Industrial production has started to turn, and so have sentiment indicators, with business confidence indexes leading the way (source: Bloomberg). Particularly encouraging are the improvements in the inflation trend. Prices have been easing […]

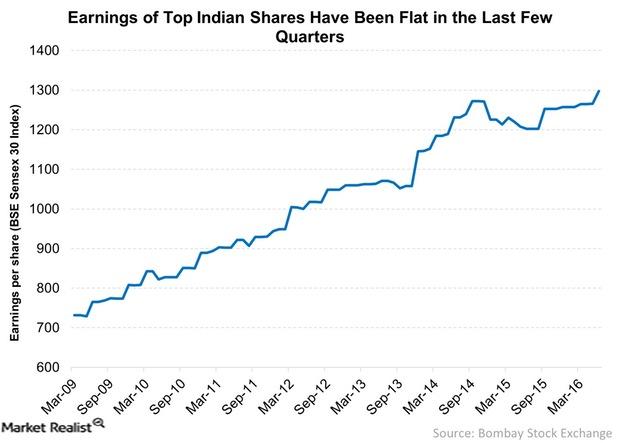

Can Indian Corporate Earnings Take a Turn for the Best?

Are Indian corporate earnings likely to turn around? Earnings have been flat since late 2014.

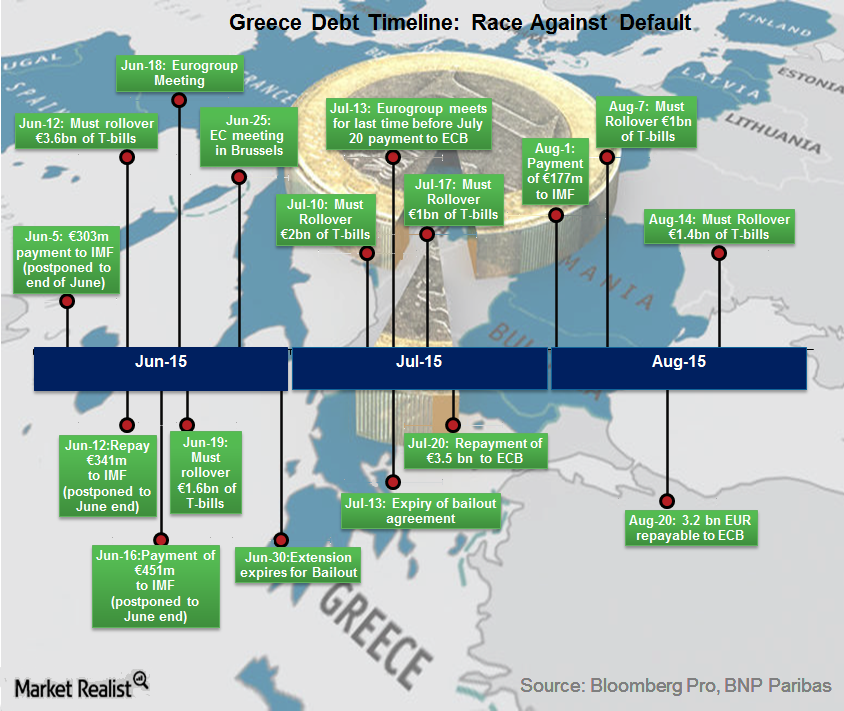

The Seemingly Never-Ending Greek Debt Saga at a Tipping Point

The seemingly never-ending Greek debt (GREK) saga continues to play out, complete with twists, turns, and obstacles à la typical potboiler.

Relatively Low Leverage Gives Tech Companies Flexibility

The debt-to-equity ratios of several top tech companies suggest that the broader markets are much more leveraged than tech stocks.

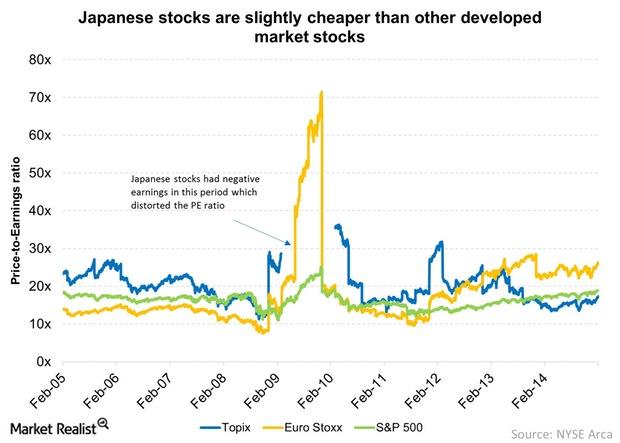

Why Japanese Stock Valuations Could Be Justified

Japan looks cheap compared to other developed markets. Japanese stock valuations can be justified if the “three arrows” are used prudently.