How Will Apple Perform in China in Fiscal 3Q17?

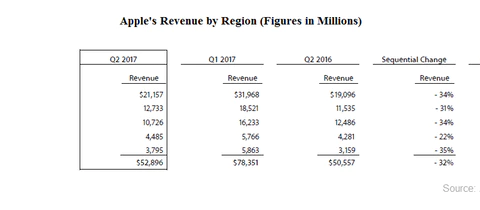

Apple’s (AAPL) revenue in Greater China fell 14% YoY (year-over-year) from $12.5 billion in fiscal 2Q16 to $10.7 billion in fiscal 2Q17.

July 24 2017, Updated 7:37 a.m. ET

Apple revenue in China continued to fall in fiscal 2Q17

Apple’s (AAPL) revenue in Greater China fell 14% YoY (year-over-year) from $12.5 billion in fiscal 2Q16 to $10.7 billion in fiscal 2Q17. The Greater China region includes China (FXI), Taiwan (EWT), and Hong Kong. China is Apple’s third-largest market after the United States (SPY) and Europe.

China was the only market in which Apple saw a revenue fall last quarter. Apple’s revenue in the Americas rose 11% YoY, whereas its revenues in Europe, Japan, and the rest of the Asia-Pacific region rose 10%, 5%, and 20%, respectively, in the quarter.

MacBook and Services revenue from China rose in fiscal 2Q17

Apple’s MacBook and Services businesses saw double-digit growth in Mainland China in fiscal 2Q17, and its retail store revenue rose a significant 27% as well. Foreign exchange fluctuations impacted Apple’s revenue by 4% in the quarter.

Apple has also been facing competition from cheaper domestic Chinese manufacturers such as Huawei, OPPO Electronics, and Vivo. We’ve already discussed how these companies are steadily improving their market shares in the global Smartphone market.

China was once Apple’s second-largest market, but its revenue has steadily fallen over the last 18 months. Apple’s CEO, Tim Cook, said, “Our March quarter results were in line with our expectations and similar to the year-over-year performance we experienced in the December quarter. We continue to be very enthusiastic about our opportunity in China.”