Will American Airlines’s Unit Revenues Continue to Decline?

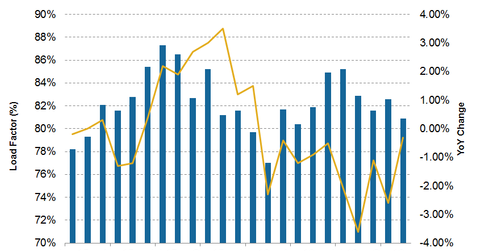

For November 2016, American Airlines’s (AAL) load factor fell 0.3% and year-to-date 2016, its load factor fell 1.3%.

Dec. 22 2016, Updated 7:36 a.m. ET

American Airlines’s load factor

As we discussed previously in this series, American Airlines’s (AAL) traffic growth has lagged its capacity growth throughout most of 2016. With the exception of January, its load factor fell throughout 2016. For November 2016, American Airlines’s load factor fell 0.3% and year-to-date 2016, its load factor fell 1.3%. This movement is expected to pressure the airline’s unit revenues.

Load factor is the most commonly used measure of an airline’s capacity utilization and is calculated by multiplying capacity and traffic. A higher load factor indicates better utilization of aircraft capacity.

Declining yields

Domestic yields (revenue per seat) have declined due to American Airlines’s (AAL) aggressive capacity growth and increased competitive pressure.

International yields have also declined due to a strong dollar, which resulted in foreign currency devaluation. Because American Airlines earns its international revenues in local currencies, it means lower revenues when translated to the dollar. Other factors impacting yield include low fuel surcharges and economic slowdowns in Brazil and Venezuela.

Outlook

American Airlines expects these factors to continue to adversely impact unit revenues. AAL projected that its passenger revenue per available seat mile (or PRASM) would fall 1%–3% in 4Q16.

This projection is better than those offered by peers United Continental (UAL) and Delta Air Lines (DAL), which expect unit revenues to fall 4%–6% and 3%–5%, respectively. Alaska Air Group (ALK) does not give any future unit revenue guidance.

Investors can gain exposure to AAL by investing in the PowerShares Dynamic Large-Cap Value Portfolio ETF (PWV), which invests 1.4% of its portfolio in AAL.