Why Wells Fargo Has a Less Risky Business Model than JPMorgan Chase

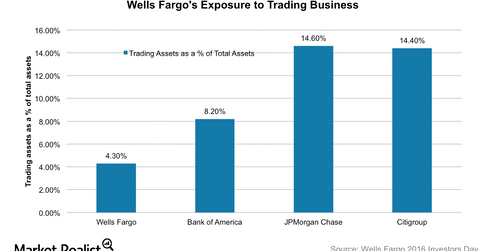

Wells Fargo (WFC) is less exposed to the risky investment banking and trading business than its peers JPMorgan Chase (JPM), Citigroup (C), and Bank of America (BAC).

Aug. 25 2016, Updated 10:04 a.m. ET

Exposure to risky businesses

Wells Fargo (WFC) is less exposed to the risky investment banking and trading business than its peers JPMorgan Chase (JPM), Citigroup (C), and Bank of America (BAC). While JPMorgan Chase and Citigroup derive 15%–20% of their non-interest income from trading activities, this income constitutes less than 1% of Wells Fargo’s income. Trading revenues contribute ~26% to JPMorgan Chase’s total income.

JPMorgan Chase

JPMorgan Chase’s (JPM) trading and investment banking businesses displayed healthy growth in the second quarter. Revenues from equities trading grew by 2% to $1.6 billion while its fixed-income trading revenues grew by 35% to $3.9 billion.

Overall, JPM’s trading revenues grew by 23% during the quarter, beating expectations of mid-teens growth by a wide margin. Trading revenues contribute 20% to JPMorgan Chase’s non-interest income.

Industry revenues

Trading revenues for the industry improved slightly as the credit markets improved. However, equity trading revenues continued to suffer even though stock markets gained. Speculation following Britain’s European Union referendum, tight regulations, and low trading volumes hurt equity trading during the quarter. Further, trading revenues were extremely strong during the same period last year.

Investors looking for exposure to the banking space could invest in the Financial Select Sector SPDR ETF (XLF) or the iShares US Financials ETF (IYF) (IYG). JPMorgan Chase and Bank of America are well represented in these ETF portfolios.