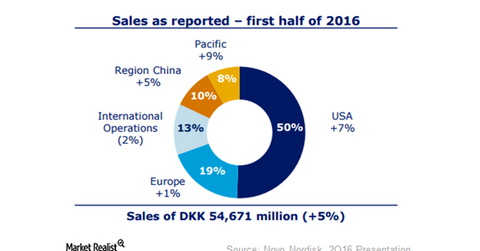

How Did Novo Nordisk Perform across Geographies in 1H16?

As of May 2016, Novo Nordisk (NVO) held a 46% share of the global total insulin market.

Aug. 9 2016, Published 3:40 p.m. ET

Novo’s performance in the United States

As of May 2016, Novo Nordisk (NVO) held a 46% share in the global total insulin market. Its share in the US insulin market remained unchanged, at 37%. Novo’s sales in the United States rose by 7% in local currency terms during the first half of 2016 and the region remained the anchor with a 50% share of growth during the period. The contribution from North America stood at 13.9 billion Danish krone during 2Q16.

The wide commercial and Medicare Part D formulary coverage for Tresiba in the United States boosted sales there. However, the contract loss for NovoLog and lower prices for NovoLog and NovoLog Mix, along with non-recurring adjustments to rebates for Medicaid patients, put pressure on the region’s growth. Peers Sanofi (SNY), AstraZeneca (AZN), and Eli Lilly and Company (LLY) are also exposed to this pricing risk. For more on Novo’s presence in the United States, please read North America Is Still Novo Nordisk’s Largest Market.

International operations

International operations grew by 11% in local currency terms in 1H16. International operations fetched 3.3 billion Danish krone in 2Q16. This growth was supported by higher sales for modern and next generation insulin.

Europe

The sales from European operations grew by 2% in local currencies in 1H16 and stood at 5.3 billion Danish krone in 2Q16. The growth in the region was driven by Tresiba, Xultophy, and NovoEight. With increased competition in the basal segment, modern insulin sales declined in the region.

China

During the first half of 2016, Novo’s sales in China grew by 11% in local currencies. China earned 2.5 billion Danish krone during 2Q16. The growth was driven by growth in the diabetes care market. With the continued expansion of the GLP-1 market in Japan and Canada, Victoza grew by 23% in local currency terms.

Pacific region

The sales in the Pacific region grew by 1% in local currencies in 1H16 and generated sales of 2.4 billion Danish krone in 2Q16. Tresiba’s strong uptake in Japan was the major growth driver in 2Q16. Victoza proved to be a winner in the region.

If you want exposure to Novo but would like to avoid excessive company-specific risks, you could consider options such as the PowerShares International Dividend Achievers Portfolio ETF (PID). PID has a 0.53% exposure to Novo Nordisk. Continue to the next part for an update on Novo’s analyst recommendations.