Inflation Stalled a Repo Rate Cut in India in August

The RBI looks at the CPI as its primary gauge for measuring inflation. The RBI has CPI growth targets to adhere to while deciding its monetary policy stance.

Aug. 10 2016, Published 11:16 a.m. ET

Inflation in India

The RBI (Reserve Bank of India) looks at the CPI (consumer price index) as its primary gauge for measuring inflation. Prior to the RBI adopting the CPI, in India (PIN) (FINGX), another measure of inflation—the WPI (wholesale price index)—was the key gauge of inflation. It’s still considered for reference. To learn more about these measures of inflation, read India’s Different Inflation Measures—WPI versus CPI.

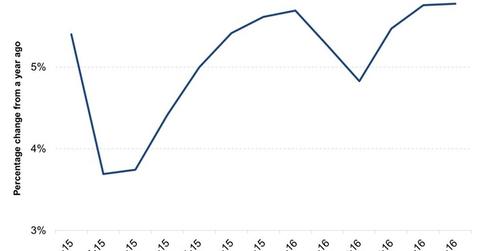

The RBI has CPI growth targets to adhere to while deciding its monetary policy stance. By January 2016, it was supposed to keep inflation below a target of 6%, which it was able to do. Its next target is to keep inflation at or below the 5% mark by March 2017. Looking at the following graph will show you why the RBI hasn’t cut the repo rate.

Consumer inflation is rising

The fall in crude oil prices—which started in mid-2014 and pummeled stocks of companies like Royal Dutch Shell (RDS.A), Total S.A. (TOT), and Tenaris SA (TS), among a host of others—was very beneficial for India. It’s a net importer of the commodity. It helped the rate of CPI growth fall from 7% in August 2014 to 3.3% in November 2014. In 2016, the rise in the index has been above 5% for all of the months until June—except March.

In fact, the pace of 5.8% in June was the highest since August 2014—a 22-month peak. The price rise has been noticeably sharper in rural India compared to the urban measure of the CPI. The rise in the rural CPI increased the pace of the combined CPI.

With inflation on the rise, the central bank couldn’t ease monetary policy at this juncture and risk fueling inflation more. This would cause it to miss its March 2017 target.

Food prices have been the main source of the rise in the CPI. We’ll discuss this in the next part.