What Could Threaten India’s Growth?

Despite the impressive reform agenda and robust GDP growth, there are several challenges facing the Indian economy (PIN) (EPI).

Aug. 31 2016, Updated 2:04 p.m. ET

“It is difficult, but not impossible, to conduct strictly honest business.” – Mahatma Gandhi

Doing business in India is harder than it should be. According to the World Bank, it takes 28 days to start a business in India. This compares with 19 days in Pakistan, 11 in Japan, four in Korea and just three in Australia. The government has reacted by waging war on red tape. It has introduced a new company registration form, effective since May 2015 and available online, that combines seven separate forms into one. In theory, this should bring the time needed to register a company down to just 48 hours in 70% of instances.

The government’s ‘Start-Up India, Stand-Up India’ campaign is the first of its kind, bridging the gap between new start-ups and venture capital and angel investors. It promises to mobilise India’s talented youth to set up new and innovative businesses. The plan offers tax exemptions to start-ups for three years and tax exemptions for investors on capital gains. Start-ups will also be able to be wound up more easily in case of bankruptcy. The initiative bodes well for the next generation of Indian companies. Alluding to Indians’ passion for cricket, one executive told us: “We’re in it for the long run. We’re playing a test match, not Twenty20.”

Between measures such as these, the government has already passed 50 or so other bills. Several of the reforms are being undertaken by the states and momentum remains strong. Multinational companies, in particular, see this as a massive game changer. Who you know in Delhi is becoming irrelevant; everyone competes on equal terms, putting them on a level playing field with domestic companies. If corruption at more local levels were drastically reduced – a key focus of Modi’s government – productivity and foreign investor demand could be boosted further. Further improvements are necessary.

For example, greater political capital should be going into the Bankruptcy Code. This could lead to re-rating of the banking system, and even the whole country. Indeed, several commentators have noted that Bankruptcy Code reform is more important legislation than the Goods and Services Tax Bill (GST). Fortunately, it could see stronger consensus and may be easier to pass and implement.

Market Realist – Despite the impressive reform agenda and robust GDP growth, there are several challenges facing the Indian economy (PIN) (EPI). According to a report by the Reserve Bank of India, corporate investment fell by a significant 27% in fiscal 2015. Corporate investments have been in constant decline over the past three years, coming in at 3.7 trillion rupees ($73 billion) in fiscal 2012, 3.1 trillion rupees ($58.7 billion) in fiscal 2013, 2.7 trillion rupees ($45.7 billion) in fiscal 2014, and 1.9 trillion rupees ($30 billion) in fiscal 2015 (sources: RBI, WSJ).

The Reserve Bank of India has attributed the sluggishness in corporate investment to low credit off-take, weak global demand, and a slowdown in the manufacturing sector.

Moreover, most of the corporate sector remains mired in dollar-denominated debt, which increases susceptibility to currency fluctuations. With the Federal Reserve set to hike rates in December, the dollar (UUP) is likely to maintain its upward trajectory, so it should continue to remain a headwind for Indian corporations.

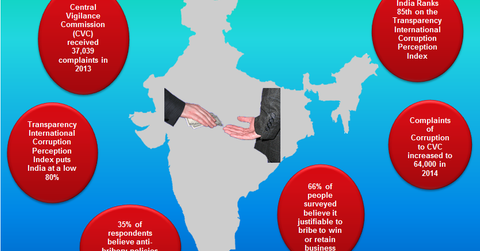

Corruption and bureaucracy remain a major source of worry for India (IFN) (INDA). As you can see in the previous graph, India ranks a dismal 85 out of 170 countries on the Transparency International Corruption Perception Index. This subpar ranking acts as a huge headwind for the domestic corporate sector. Moreover, rampant bureaucracy and red tape discourage foreign investors from entering Indian markets. Infrastructural weaknesses also seem to plague the country, hindering India from achieving its true growth potential.