Do Dividend Growers Look Appealing?

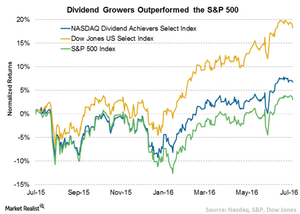

Historically, dividend growers have often performed better than the S&P 500 (IVV) and provided higher income during Market volatility.

Aug. 17 2016, Updated 9:06 a.m. ET

We prefer dividend growers and quality companies in the current low-rate environment. We’re focusing on companies with rising dividends, strong cash flows and low payout ratios. An added bonus for dividend growers: We see them outperforming when the Federal Reserve (Fed) eventually raises rates. We also like stocks in selected emerging markets.

What would make us more bullish toward stocks overall? A pickup in earnings growth, or a shift toward fiscal expansion and structural reform.

Market Realist – Dividend growers could outperform

Dividend growth stocks, or dividend growers (HDV), are the companies that generally have a long track record of consistently growing their dividends. They’re different from other dividend stocks, which may provide dividends on a more regular basis that are higher in some cases.

Dividend (DVY) growth stocks with a potential of consistently growing dividends look attractive. Historically, dividend growers have often performed better than the S&P 500 (IVV) and provided higher income during Market volatility. The better performance stems from the fact that many dividend growers are high-quality companies generating higher free cash flows, which allows them to grow their dividends consistently.

US stocks outperformed the benchmark

Usually, a dividend-focused (IDV) portfolio is likely to provide a higher yield and lower returns compared to a growth-oriented portfolio. However, this has not always been the case. In the first half of 2016, US dividend stocks outperformed the S&P 500 (IWF) by a wide margin.

The NASDAQ US Dividend Achievers Select Index, which is comprised of securities with at least ten consecutive years of increasing dividend payments, has risen 9% YTD (year-to-date). Similarly, the Dow Jones U.S. Select Dividend Index, which represents the country’s leading stocks by dividend yield, has risen 16.7% YTD. The S&P 500 has risen a mere 5.5%.

Equities: No rebound in sight

Equity markets aren’t likely to witness sharp rebounds unless the global economy turns around and gathers momentum. For that to happen, major countries probably need to initiate fiscal expansion measures. Structural measures aimed at resolving long-term issues could provide a boost to economic growth.