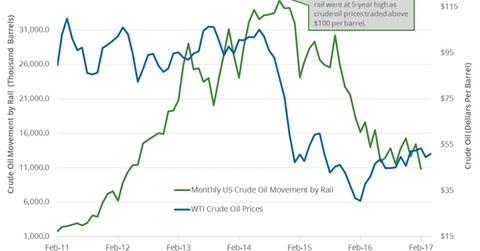

How Did Crude Oil Movement by Rail Trend in February 2017?

The US Energy Information Administration estimates that US crude oil movement by rail fell by 3,546,000 barrels to 10,850,000 barrels in February 2017.

May 31 2017, Published 8:24 a.m. ET

US crude oil movement by rail

The US Energy Information Administration predicted that US crude oil movement by rail fell by 3,546,000 barrels to 10,850,000 barrels in February 2017 compared to January 2017, which was the biggest monthly drop since June 2016.

US crude oil movement fell 24.6% in February 2017 compared to the previous month. It also fell 32.8% from the same period in 2016. US crude oil movement by rail includes shipments to and from Canada. The movement of US crude oil by rail has been falling since October 2014.

Regional crude oil movement by rail

According to the EIA, US crude oil movement by rail averaged 388,000 bpd (barrels per day) in February 2017.

The EIA divides the US into five storage regions. The crude oil receipts for these regions in February 2017 were as follows:

- East Coast (or PADD1) receipts from the US and Canada were at 122,000 bpd in February 2017 compared to 231,000 bpd year-over-year.

- Midwest (or PADD 2) receipts from the US and Canada were at 34,000 bpd in February 2017 compared to 4,000 bpd year-over-year.

- Gulf Coast (or PADD 3) receipts from the US and Canada were at 67,000 bpd in February 2017 compared to 169,000 bpd year-over-year.

- Rocky Mountain (or PADD 4) receipts from the US and Canada were less than 5,000 bpd in February 2017.

- West Coast (or PADD 5) receipts from the US and Canada were at 165,000 bpd in February 2017 compared to 147,000 bpd year-over-year.

PADD 1, PADD 3, and PADD 5 are the most active for crude-by-rail receipts. In contrast, PADD 2 is the most active in regards to outgoing rail shipments.

Impact on MLPs

The rise or fall in crude oil movements by rail can affect midstream companies like Genesis Energy (GEL) and Enterprise Product Partners (EPD). Plus, infrastructural availability or constraints can influence crude oil (UCO) (SCO) (BNO) (PXI) (USL) prices.

In the last part of this series, we’ll take a look at why Goldman Sachs downgraded crude oil price forecasts.