Rice Energy’s Organizational Structure: A Brief Overview

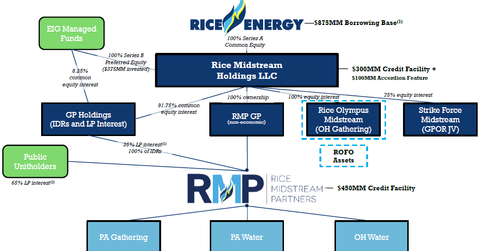

In its organizational structure, Rice Energy, through its GP Holdings subsidiary, and the public hold 35% and 65% limited partner interest, respectively, in Rice Midstream Partners.

Aug. 19 2016, Updated 9:05 a.m. ET

Rice Midstream Partners

On December 8, 2014, Rice Energy (RICE) announced the IPO (initial public offering) of Rice Midstream Partners (RMP). RMP operates midstream assets in the Marcellus and Utica regions.

Organizational structure

As you can see in the above organizational chart, Rice Energy through its GP Holdings subsidiary and the public hold 35% and 65% limited partner interest, respectively, in Rice Midstream Partners. Rice also owns the partnership’s incentive distribution rights (or IDRs) through GP Holdings.

Rice Energy owns 100% of the equity interests in Rice Midstream Holdings (or RMH), which in turn holds 100% equity interest in RMP GP, RMP’s general partner. RMH also holds 91.75% of the equity interests in its GP Holdings subsidiary. The remaining 8.25% is held by EIG Managed funds, a subsidiary of EIG Global Partners, a private equity firm.

Apart from IDRs and limited partner interests, Rice Midstream also owns a 100% equity interest in Rice Olympus Midstream, which provides midstream services to RICE and other Southeast Ohio producers.

RMH also owns a 75% equity interest in Strike Force Midstream, RICE’s midstream joint venture in the Utica, with Gulfport Energy (GPOR).

Rice Midstream Partners: Key assets

RMP’s key assets include its Pennsylvania dry gas gathering system and its Pennsylvania and Ohio water distribution services business. Its Pennsylvania dry gas gathering system caters primarily to RICE and EQT (EQT) and other Marcellus producers.

A presentation released in May 2016 noted that RICE’s Ohio dry gathering system and its Strike Force JV with GPOR could be a future dropdown candidate into RMP.