What Benefited ADM’s WILD Flavors and Specialty Ingredients in 2Q16?

Archer Daniels Midland’s management mentioned that the WILD Flavors and Specialty Ingredients’ results were in line with the same quarter last year.

Aug. 8 2016, Updated 11:05 a.m. ET

WILD Flavors and Specialty Ingredients

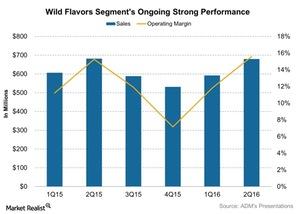

In the 2Q16 earnings call, Archer Daniels Midland’s (ADM) management mentioned that the WILD Flavors and Specialty Ingredients’ results were in line with the same quarter last year. Strong growth in flavors and systems benefited the segment’s results in the second quarter. However, the results were partially offset by slower specialty ingredient sales and startup items. The segment earned $106 million in operating profit in the quarter.

It included ~4 million in operational startup costs for the Tianjin Fibersol facility in China and the Campo Grande specialty protein complex in Brazil. Management mentioned that the WILD Flavors and Specialty Ingredients segment is expected to perform better in 2H16. This would result in YoY (year-over-year) operating profit growth of more than 20%.

Harvest Innovation

During 1H16, Archer Daniels Midland spent $120 million on acquisitions including Harvest Innovations in the WILD Flavors and Specialty Ingredients segment, Medsofts, and Ag Services in Morocco in the Corn Processing segment. Harvest Innovations was an addition to this segment in 1Q16. It’s meant to enhance the company’s plant protein and gluten-free ingredients portfolio.

Archer Daniels Midland’s industry competitors include Hormel Foods (HRL), WhiteWave Foods (WWAV), and Kellogg (K). They saw operating profit of $360 million and $92 million. Kellogg reported a loss of $39 million, respectively, in its last reported quarter. The PowerShares High Yield Equity Dividend (PEY) and the Consumer Staples Select Sector SPDR Fund (XLP) invest 1.2% and 1.5% of their respective portfolios in Kellogg.