What Analysts Recommend for Noble Energy after Its 2Q16 Earnings

Approximately 63% of analysts rate Noble Energy (NBL) a “buy,” and 34% rate it a “hold.” The remaining ~3% rate it a “sell.”

Aug. 9 2016, Updated 11:05 a.m. ET

Consensus rating for Noble Energy

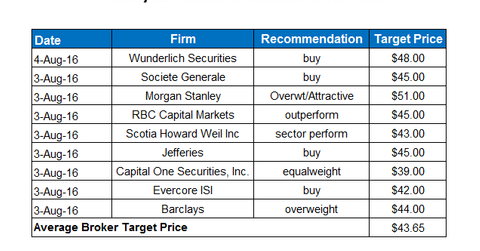

Approximately 63% of analysts rate Noble Energy (NBL) a “buy,” and 34% rate it a “hold.” The remaining ~3% rate it a “sell.” The average broker target price of $43.65 for NBL implies a return of ~31% in the next 12 months.

Upstream peers EQT (EQT) and Chesapeake Energy (CHK) have implied returns of ~18% and -9%, respectively, in the next 12 months.

High, low, and median analyst target prices for Noble Energy are $51, $35, and $44, respectively. NBL is a component of the SPDR S&P North American Natural Resources ETF (NANR). The NANR ETF invests 0.75% of its portfolio in the company.