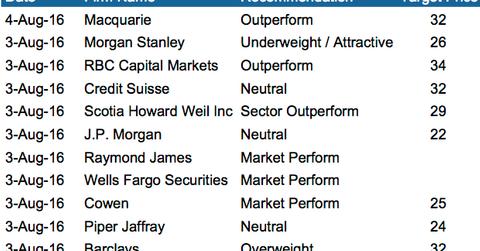

What Are Analysts’ Recommendations for HollyFrontier?

The analysts’ survey shows that six out of the 11 companies surveyed rated HollyFrontier (HFC) as “neutral” or “market perform.”

Aug. 10 2016, Updated 9:04 a.m. ET

Analysts’ recommendations

The analysts’ survey shows that six out of the 11 companies surveyed rated HollyFrontier (HFC) as “neutral” or “market perform.” The highest and lowest 12-month price targets stand at $34 and $22—this indicates a 28% rise and 17% fall from its current levels, respectively. The average target price of $28 implies a 7% gain.

Peers’ recommendations

In comparison, Marathon Petroleum (MPC), Valero Energy (VLO), and Phillips 66 (PSX) have been rated as a “buy” by 68%, 62%, and 22% of the analysts surveyed, respectively. For exposure to energy sector stocks, you can consider the PowerShares Dynamic Large Cap Value ETF (PWV). PWV has ~5% exposure to the sector.