ADM’s Stock Fell 2% Due to Weaker Performance in 2Q16

Archer Daniels Midland (ADM) reported its 2Q16 results on August 2. The stock didn’t react well to the results. It fell 2% on the same day.

Aug. 10 2016, Updated 11:04 a.m. ET

Archer Daniels Midland fell after its 2Q16 results

Archer Daniels Midland (ADM) reported its 2Q16 results on August 2. The stock didn’t react well to the results. It fell 2% on the same day. It closed at $43.45—compared to the previous day’s closing price of $44.24. As we discussed in the previous parts of the series, the company’s earnings and revenue missed estimates for the quarter with declining growth year-over-year. However, the stock rose 1% after the company announced a dividend and closed at $43.93 on August 3.

The stock also fell 3% after the company reported disappointing first-quarter results on May 3. Revenue and earnings also missed estimates in the first quarter. The stock closed 1% higher on April 19 when it announced investment for National Foodworks Services’ new headquarters. On June 1, the stock closed 0.14% higher after the company announced the completion of the acquisition of a Morocco-based corn wet mill. Read Why Did ADM Acquire a Moroccan Sweetener Facility? to learn more.

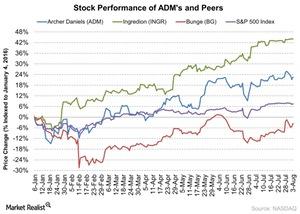

It lost 30% in fiscal 2015 due to negative earnings growth and weaker sales in most of the company’s operating segments. So far in 2016, Archer Daniels Midland has gained 23% as of August 3. It outperformed the Market represented by the S&P 500 Index by 15% as of August 3. It closed at $43.93 on August 3.

Peers’ stock performance

Along with its four segments, Archer Daniels procures, transports, stores, processes, and merchandises agricultural commodities and products. The stock has gained 12% since its last quarter results.

So far in 2016, Archer Daniels Midland’s peer Ingredion (INGR) has gained 44%, while Bunge (BG) has lost 4%, respectively. They closed at $133.66 and $64.46, respectively, on August 3. The PowerShares High Yield Equity Dividend (PEY) and the SPDR S&P Dividend ETF (SDY) invest 1.4% and 1.3% of their portfolio in Archer Daniels Midland.