How Vivint Solar’s Customers Benefited from Solar Tax Credits

ITCs (investment tax credits) are a dollar-for-dollar reduction on an income tax bill. It is applicable to both residential and commercial deployment of solar systems.

April 7 2016, Updated 4:06 p.m. ET

SRECs

According to Renewable Portfolio Standards (or RPS), it is mandatory in some states that utilities are required to produce a portion of their generation from solar generators. In the absence of such generation, utilities can buy SRECs (solar renewable energy certificates) from the market or solar panel owners to meet their requirements. One SREC corresponds to 1 mWh (megawatt hour) of solar electricity.

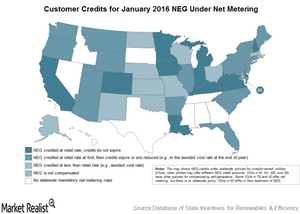

Net metering

Net metering allows the customers to earn credits for the net excess generation (or NEG) from their solar panels. Excess electricity generated during the daytime is sent to the grid, which is recorded if the house is net metered.

This will be credited against the electricity consumed during nighttime. Customers are charged only for the net amount of electricity consumed from the grid.

ITCs

ITCs (investment tax credits) are a dollar-for-dollar reduction on an income tax bill. It is applicable to both residential and commercial deployment of solar systems. The owners of the solar system are eligible for a maximum tax credit of 30% of their investment value in the applicable solar systems if their construction commences before December 31, 2019. Thereafter, the tax credit amount will gradually be reduced to 26% for constructions in 2020, 22% in 2021, and 10% in 2022.

It is important for incumbent solar (TAN) companies like Sunrun (RUN), SolarCity (SCTY), Vivint Solar (VSLR), and Sunpower (SPWR) to plan their project execution accordingly to take advantage of the maximum tax credits.

Other incentives

Apart from the above-mentioned benefits, owners of solar systems also enjoy accelerated depreciation on their solar assets. This helps in the immediate reduction of the tax burden. Other benefits include property tax exemptions and sales tax exemption in certain states. Also, some states offer cash rebates and STCs (state tax credits) to promote the installation of solar systems.

In the next part of this series, we’ll learn about Vivint Solar’s key operational metrics.