How Does Vivint Solar Make Money?

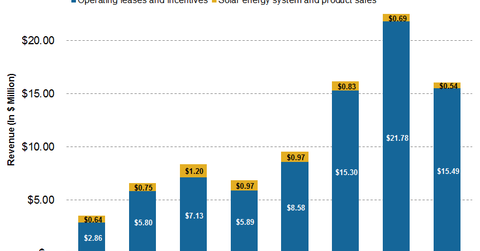

Vivint Solar’s business model is divided into two revenue segments: Operating Leases and Incentives and Solar Energy Systems and Product Sales.

April 7 2016, Updated 4:06 p.m. ET

Vivint Solar’s revenue generation model

Vivint Solar’s business model is divided into two revenue segments: Operating Leases and Incentives and Solar Energy Systems and Product Sales. The two segments together span the complete value chain of the residential solar service model.

Operating leases and incentives

Operating Leases and Incentives is the primary revenue generating segment for Vivint Solar. Revenue under this segment mainly includes proceeds from customer agreements, solar energy system rebate incentives, and sales of SRECs (solar renewable energy certificates). Revenues include any revenue associated with ITCs (investment tax credits) assigned to investment funds that are classified as lease pass-through arrangements.

Customer agreements can be of two types: solar lease agreements and power purchase agreements (or PPAs). In a solar lease agreement, the company receives a fixed monthly payment from the customers for using the solar systems installed on their premises.

In a PPA, it receives a fixed pay per kWh of power generated by the system. Revenue from this segment is recorded net of sales tax collected.

Solar energy system and product sales

Revenue under this segment mainly includes proceeds from the sale of solar (TAN) panels, the sale of photovoltaic installation devices, and software products. Unlike in a PPA or lease pass-through arrangement, the customer will own the solar system upon completion of the transaction and, therefore, will be eligible for federal tax credits, incentives, and other state tax rebates.

Revenue under this segment is recognized after installation and interconnection of the solar system to the grid, subject to final inspection by the regulating authority of that particular area.

Extension of ITCs for investments in solar energy has been key for the rapid expansion of downstream solar companies like Vivint Solar (VSLR), Sunrun(RUN), SolarCity Corporation (SCTY), and SunPower Corporation (SPWR).

In the next part of this series, we’ll learn about various tax credits, incentives, and rebates available for owners of eligible solar products.