Analyzing Panera Bread’s Valuation Multiples

Lower revenue and EPS estimates made investors skeptical about investing in Panera. As of September 19, it was trading at 28.1x—down from 30.9x on July 28.

Sept. 21 2016, Updated 8:04 a.m. ET

Valuation multiples

Investors should look at valuation multiples when deciding whether to buy or sell a stock. Valuation multiples are driven by perceived growth, risk and uncertainties, and investors’ willingness to pay for a stock.

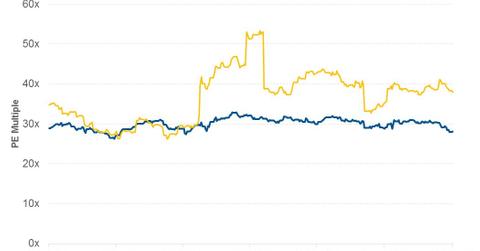

There are various multiples used to evaluate a stock. In this part of the series, we’ll use the PE (price-to-earnings) multiple due to its high visibility in Panera Bread’s (PNRA) earnings. The forward PE multiple is calculated by dividing the current share price by the forecast EPS (earnings per share) for the next 12 months.

Panera’s PE multiple

The lowering of revenue and EPS estimates along with softening growth in restaurants made investors skeptical about investing in Panera. This led to a decline in Panera’s share price as well as its PE multiple. As of September 19, 2016, Panera was trading at 28.1x—down from 30.9x on July 28, 2016. Panera’s peers such as Chipotle Mexican Grill (CMG), Shake Shack (SHAK), Brinker International (EAT), and Buffalo Wild Wings (BWLD) were trading at 50.9x, 67.4x, 14.6x, and 25x, respectively.

Risks and uncertainties

With the intention of increasing its sales, Panera has been focused on implementing Panera 2.0. This is expected to increase Panera’s investments. If the investments don’t generate the desired sales growth, it could put pressure on Panera’s margins and lower its earnings. Currently, analysts are expecting the company to post EPS of $7.1 in the next four quarters—year-over-year growth of 7.5%. The EPS growth might have been incorporated into the current share price. If the company’s results are lower than this estimate, Panera could face selling pressure. This could bring its PE ratio down more or vice versa. You can mitigate these company-specific risks by investing in the iShares S&P Mid-Cap 400 Growth ETF (IJK). IJK has invested 0.65% in Panera Bread.

In the final part of this series, we’ll look at analysts’ recent recommendations as well as the price target for the next 12 months.