Urea Prices: The Continuing Decline Last Week

Granular urea prices in the Middle East declined 5% to $200 per metric ton in the week ended July 1. It was $210 per metric ton in the previous week.

Dec. 4 2020, Updated 10:53 a.m. ET

Urea prices still declining

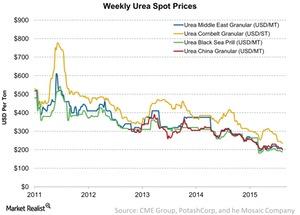

In the previous part of the series, we saw that overall ammonia prices declined for the week ended July 1, 2016. Urea prices also fell during the week. Urea is the most commonly used nitrogen fertilizer in the world.

Granular urea prices

Granular urea prices in the Middle East declined 5% to $200 per metric ton in the week ended July 1. It was $210 per metric ton in the previous week. Urea prices fell by 37% in the Middle East from $315 per metric ton in the corresponding week in 2015. However, current urea prices remain above the low of January 2016 when they hit $195 per metric ton.

Granular urea prices in China also declined by 1% to $205 per metric ton week-over-week from $208 per metric ton. Granular urea prices in China fell 34%, from $310 per metric ton in the same week last year to a low point of $200 per metric ton in March 2016.

Granular urea prices in the Corn Belt fell 2% to $213 per metric ton FOB (free on board) from $217 per metric ton in the previous week. Current granular urea prices in this region hit a four-year low. YoY (year-over-year), they fell 43% from $376 per metric ton.

Prilled urea prices

Prilled urea prices remained unchanged week-over-week in the Black Sea, at $190 per metric ton. They fell to a low of $183 per metric ton in January 2016. They fell 36% year-over-year from $295 per metric ton in the corresponding week of 2015.

Urea prices have hit multiyear lows in 2016, which presents a challenge for nitrogen fertilizer producers such as CF Industries (CF), CVR Partners (UAN), and Agrium (AGU). Falling prices also affect ETFs such as the Vanguard Materials ETF (VAW).

VAW invests ~10% of its holdings in agricultural chemical companies, including Monsanto (MON) and DuPont (DD).

In the next part of this series, we’ll look at natural gas, a key input cost for nitrogen fertilizers. According to PotashCorp, natural gas accounts for 70%–85% of ammonia production costs.