Sharp Fall in Crude Oil Price Dictate the Currencies Markets

Looking at the performance of the major commodity-driven currencies on July 25, the Nigerian naira was the biggest casualty.

Nov. 20 2020, Updated 3:48 p.m. ET

Crude oil fell by over 2.5%, currencies followed suit

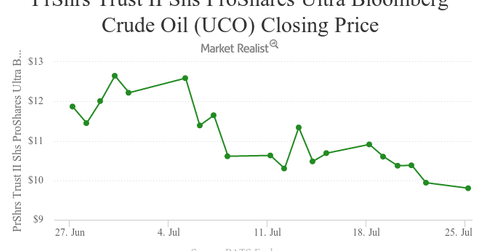

The crude oil (USO) (UCO) futures saw a large dip on July 25 as the September futures fell by 2.5%. Apart from the fall in the directly related ETFs like the United States Oil ETF(USO) and the ProShares Ultra Bloomberg Crude Oil ETF (UCO) which fell by 2.8% and 5.4%, respectively, the fall had a marked impact on the currency markets.

[marketrealist-chart id=1480356]

Commodity-related currencies have usually shown a high correlation to the change in crude oil prices. For more details on the correlation of currency markets to crude oil prices, read Ruble and Crude in Near Perfect Synchronization.

Looking at the performance of the Russian ruble on July 25, the US dollar-Russian ruble currency pair, which is inversely related to the ruble, rose by 0.85%.

Commodity currencies fall

Looking at the performance of the major commodity-driven currencies on July 25, the Nigerian naira—which is already under heavy pressure due to dwindling foreign exchanges reserves—was the biggest casualty. The US dollar-Nigerian naira currency pair, which is inversely related to the naira, rose by 4.6% on July 25.

[marketrealist-chart id=1480389]

Other major commodity currencies like the Canadian dollar and Brazilian real had a similar fall. They fell by 0.66% and 0.91% against the US dollar, respectively.

Impact on the currency ETFs

US dollar–based ETFs were trading on a flat note on July 25. The WisdomTree Bloomberg US Dollar Bullish ETF (USDU) rose by 0.08%, while the PowerShares DB US Dollar Bullish ETF (UUP) had a slight fall of 0.16%. The Guggenheim CurrencyShares Canadian Dollar ETF (FXC) fell by 0.58%.

The Guggenheim CurrencyShares Japanese Yen ETF (FXY) rose by 0.35% on July 25. Markets are starting to doubt whether the Bank of Japan will meet the market expectations in terms of further easing. For more details read, Why the FOMC, BoJ, and EBA Will Drive Markets This Week. The Guggenheim CurrencyShares Euro ETF (FXE) had a slight rise of 0.17%.